Beauty & Diversity 2024: Market & Consumer Insights - Part 1

This two-part report will help beauty and wellness brands understand how to develop products for diverse audiences and create more inclusive marketing and social campaigns.

Part 1 focuses on what's happening currently in the beauty diversity space with consumer insights and data, plus the key considerations all beauty brands must think about when developing products for diverse communities.

This report is part of the diversity and inclusivity in the beauty industry series, which includes the following:

- Beauty & Diversity 2024: market & consumer insights - part 1 - HERE

- Beauty & Diversity 2024: brands & product trends - part 2 - HERE

- Accessible Beauty: the new priority in inclusivity - HERE

- Age-Inclusive Beauty - in progress

Market Insights

Bridging the skin colour research gap

Diversity and inclusion is now a standard in the beauty industry. Consumers expect beauty brands to offer inclusive products - from a wider palette of foundation shades to haircare for all hair types, including coily and textured hair.

Yet, there is still a wide diversity gap within the skincare sector and a huge disparity when it comes to cosmetic products as not many are tested on people of colour. Dermatologists of colour are underrepresented in the industry. Only 3% of dermatologists in America are Black, despite 12.8% of the population being African American. Even smaller is the fact that only 4.2% of dermatologists are Hispanic, resulting in a major gap in professional expertises for this demographic.

In a 2020 review of “130 publications relating to manifestations of Covid-19 on the skin”, 92% of the images shown were for fair skin types, with no images for very dark skin.

Past research has historically been skewed towards lighter skin tones, however, we’re starting to see some progress coming into the spotlight.

In November 2023, Boots, No7 Beauty Company, and The University of Manchester (UoM) secured a multi-million pound funding for inclusive dermatology research. Known as Project Spectrum, the partnership will explore how skin structure, function and response to sunlight is influenced by melanin - the pigment that determines skin colour - with the aim to deliver effective skin care to meet the needs of all people. This new programme is setting a new standard for greater inclusivity in the skincare category space.

In March 2023, L’Oréal USA dedicated a $100,000 research grant to the Skin of Color Society (SOCS) to promote more research on the treatment of skin diseases in people of colour.

Meanwhile, skincare brand 4.5.6 Skin created the world’s first Skin Tone Research Lab, a research hub to support the brand in formulating and manufacturing products that address the huge research & development gap in serving the needs of people with melanin-rich skin.

In May 2022, A.S Watson-owned retailer Superdrug pledged it would increase SPF testing on darker tones by up to 35% as part of its Shade Of You campaign - an initiative that aims to implement 10 actionable inclusivity changes across the business.

To close the gap and improve skin care information for people of colour Vaseline collaborated with HUED and VisualDx, in 2022, to launch See My Skin - a database of skin conditions shown on skin of colour, which provides consumers with educational resources for caring for, treating and monitoring skin at home while also connecting them to board-certified dermatologists. Users are invited to submit their own images in order to improve the representation of skin of colour.

Brands are starting to push the boundaries of inclusivity beyond the outdated Fitzpatrick scale (see further down for more explanation about this system).

For the launch of Dior’s Capture Total Serum, Le Serum, the brand developed a new inclusive skin classification platform: T.O.T.A.L (which stands for Tones, Omnigender, Types, Ages and Location) to test the efficacy of the product on all skin tones. Dior developed a span of 110 complexion hues powered by the colour system Pantone and recruited 600 people (300 were people of colour and it included all ages, genders and skin types from around the world) to test the product formula on.

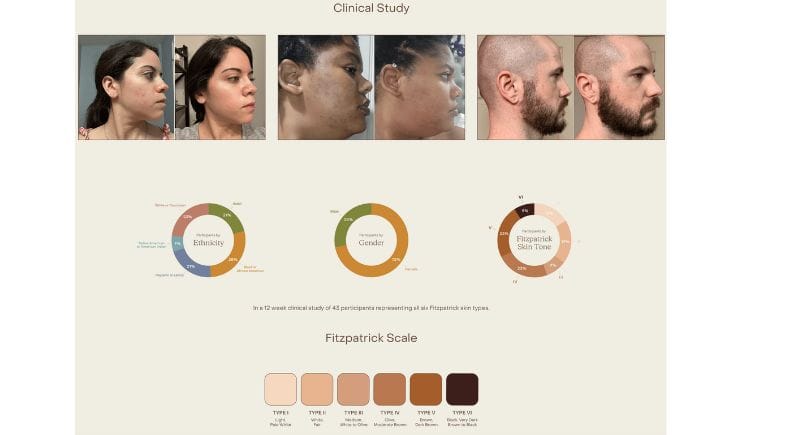

Beauty brand Sepia is another great example - the company includes clinical studies on all skin tones. The brand’s debut product Eventide Retinol Renewing Serum has been tested on all skin tones that represent all six Fitzpatrick skin types. Sepia’s ‘Skinclusive Clinical Studies’ features participants from multiple ethnicities including Asian, Black or African American, Hispanic or Latino, Native American or American Indian, and White or Caucasian.

LA-based company SULA LABS is a Black-owned cosmetic research & development lab that develops and tests beauty formulas and ingredients on darker skin tones. It includes a group of chemists, product development experts and scientists, led by founder AJ Addae.

Consumer Insights

According to a survey by Lycored, a well-being product and health food ingredient brand, it found that three quarters of people with dark skin in the UK and US find it hard to find the right products for their skin.

The survey also revealed that what consumers want from their skincare varies depending on skin tone.

- Consumers with dark skin cite healthy glow and radiance as their main skincare goal, with 67% of people with dark brown skin saying this is their top priority, compared to 51% of pale or fair-skinned consumers.

- More than half (64%) of people with dark brown or darker skin surveyed said they do not believe that the beauty industry does enough to meet the needs of people of all skin tones compared to 24% of people with white skin.

74% of those surveyed with dark skin said they find it hard to find products for their skin tone and dark-skinned consumers are more likely to look for skincare tailored to their skin tone.

- 56% of respondents said they think the beauty industry has improved at meeting the needs of people of all skin tones in recent years.

Black beauty consumers: key stats in the US

- 13.4% of the US population is made up of Black Americans (Pew Research Center).

- In 2021, Black Americans spent $6.6 billion on beauty - that’s 11.1% of the total US beauty market (McKinsey & Company, Black representation in the beauty industry report 2022).

- 68% of US consumers would like to see diversity in beauty advertising as it reflects real life (Mintel).

43% of younger consumers strongly agree the beauty industry should be more inclusive (Mintel).

- By 2024, the buying power of the US black population is set to reach $1.8 trillion (Nielsen Consumer LLC).

- Black population in the US is expected to grow by 21% between 2022-2045, while non-Hispanic White population is likely to decrease by 18% (2018 American Community Survey).

Findings from McKinsey’s Institute for Black Economic Mobility found that Black Americans are three times more likely than non-Black customers to walk away from a retailer dissatisfied with their hair care, skincare, and makeup options. Black consumers drive 11% of beauty spending, but only 4 to 7% of beauty brands carried by retailers are brands created for Black consumers.

Key stats in the UK

The Black Pound Report 2022: A Study of the Multi-Ethnic Consumer, produced by cultural change agency BACKLIGHT which looks at the consumer spending power and untapped potential and profitability of the UK’s Black, Asian, and Multi-Ethnic consumer, found that multi-ethnic consumers spend 25% more on health and beauty than other consumers and this figure rises to 30% for Black women.

- 93% of Multi-Ethnic consumers think that brands have a responsibility to approach diversity and inclusivity.

- 8 in 10 Multi-Ethnic consumers would make a point of telling their friends about it if a company or brand impressed them in some way.

- 59% of Black, Asian and Multi-Ethnic people say they are more likely to purchase products from a brand with an inclusive product range.

Shopping for beauty products: the challenges

According to McKinsey & Company, black consumers face challenges in finding suitable beauty products on store shelves. Research found that 75% of consumers can be dissuaded from purchasing a product when an advertisement does not reflect racial diversity.

There is a need to increase product availability and accessibility for people of colour when shopping for beauty products.

- On average, Black consumers travel 3.36 miles to a specialty beauty store, about 21% further than non-Black consumers.

- Black consumers also need to travel more than 17% further than non-Black consumers to department stores to access expert customer service from behind a makeup counter.

Black beauty consumers have difficulty finding products that meet their needs at the retailers where they most commonly shop.

A 2021 study by Superdrug found that Black and mixed-heritage consumers can’t easily access beauty products that are suitable for their skin and hair types on the high street. 41% of respondents said they find it difficult to buy make-up shades that match their skin tone.

- 47% of respondents from a McKinsey & Company survey said they typically buy beauty products at a mass market retailer or a grocery store, yet only 13% said it’s easy to find beauty products that meet their needs there.

- 73% of consumers surveyed said that Black beauty products were often out of stock when they went to buy them. 44% reported that when they were in stock, they were hard to find.

The Black Pound Report 2022 showed that around 40% of Black female shoppers struggle to find appropriate shades.

Classifying Skin Tone

The Fitzpatrick Skin Scale

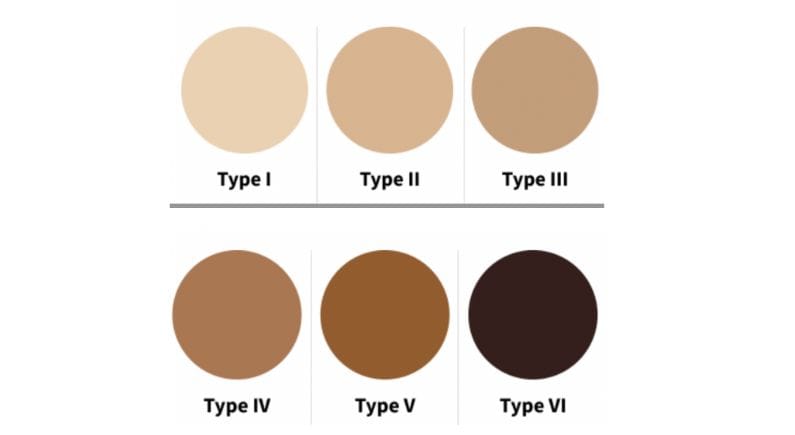

Created by Harvard dermatologist Thomas Fitzpatrick in 1975, the Fitzpatrick Skin Type scale is used to classify the skin by its reaction to sun exposure and UV radiation.

It is based on six skin types, with type V and VI added to include darker skin tones in 1988. Dermatologists use the Fitzpatrick scale to classify skin types and assess the risk of skin cancer.

Six types of skin:

- Type I - pale skin, blue/green eyes, always burns, does not tan

- Type II - fair skin, blue eyes, burns easily, tans poorly

- Type III - darker white skin, tans after initial burn

- Type IV - light brown skin, burns minimally, tans easily

- Type V - brown skin, rarely burns, tans darkly easily

- Type VI - dark brown or black skin, never burns, always tans darkly

The Monk Skin Tone (MST)

The Monk Skin Tone (MST) was created by Dr. Ellis Monk, a Harvard professor and sociologist who has been studying how skin tone and colourism affect people’s lives.

In May 2022, Google teamed up with Dr.Monk to develop a new skin tone scale featuring a wider spectrum of skin tones that reflect today’s society and diverse community.

MST is a 10-shade scale that represents a broader range of communities and is used by Google to improve skin tone representation in searches and photos.

Eumelanin Human Skin Colour Scale

The Eumelanin Human Skin Colour Scale (EHSCS), which is named after the common pigment found in skin, was launched by members of the British Association of Dermatologists’ Lexicon Group in 2022.

The five-point scale aims to combat underrepresentation in research and is a more evidence-based approach to describing the range of human skin colours. The scale is based on the melanin index (MI) - which the British Association of Dermatologists describes as “determined by the way a person’s skin reflects light of predetermined wavelength(s)”. By measuring the amount of light reflected from the skin, the scientists have developed five sections:

- Eumelanin Low

- Eumelanin Intermediate Low

- Eumelanin Intermediate

- Eumelanin Intermediate High

- Eumelanin High

Skin needs of different consumers

Key skin considerations for Black consumers

“Darker skin tones have larger and hyperactive melanocytes (the little cells that produce the melanin pigment). Melanin is also produced through different pathways and plays a protective role for the skin, meaning every trauma on the skin will trigger the melanocytes to go into overdrive and produce excess melanin causing hyperpigmentation and dyschromia.” - 4.5.6 Skin

Hyperpigmentation is the most common concern in skin of colour

- More prone to developing dark spots caused by an overproduction of melanin and appears as patches on darker skin colour. According to Haut.AI, 75% of people with a deeper skin tone suffer from post inflammatory hyperpigmentation or scarring.

Darker skin needs more hydration than Caucasian skin

- Due to thicker skin - the stratum corneum contains four more layers than lighter skin types, making it harder to retain moisture.

- Studies have demonstrated that darker skin tones can more easily lose water through the outermost layer known as the epidermis, a phenomenon known as transepidermal water loss.

- Additionally, compared with lighter skin, melanin-rich skin has more skin layers in the epidermis, and will typically shed these layers of skin at a greater rate causing ashy skin.

“Darker Skin absorbs more light than it reflects and skin cell shedding occurs at a rate 2.5 times higher in darker skin than with lighter skin phototypes resulting in a more dull appearance.” - 4.5.6 Skin

More prone to acne and breakouts

- Sebaceous glands are larger and produce more sebum leading to enlarged pores, pimples, congestion, and a lengthier cell renewal process.

Key skin considerations for Asian consumers

Most concerned with pigmentation issues and skin discolouration

- 90% of Asian patients have acne scarring and 58.2% have post-inflammatory hyperpigmentation, according to Haut.AI data.

- Sun-induced age spots are more visible on Asian skin.

Increased sensitivity

- Asian skin generally has a higher elasticity than Western skin, but Asian skin has a thin outermost layer which leaves the skin susceptible to sensitivity.

South Asian skin is more prone to acne

- Excess sebum levels makes it more prone to acne and breakouts.

According to an article in Vogue India, celebrity dermatologist Dr Jaishree Sharad said that pigmentation like melasma, periorbital melanosis (under eye circles) and periorial melanosis (pigmentation around the mouth) are the most common skin concerns faced by Indian skin tones.

Key skin considerations for Latinx/Hispanic consumers

Dry skin is a key concern

According to NielsenIQ The Hispanic Beauty Consumer Report (September 2022), the leading skin needs or concern for Latina women are:

- Dry skin - 39%

- Oily or combination skin - 38%

- Sensitive skin - 35%

- Acne - 34%

- Ageing - 32%

- Sun protection - 31%

Key skin considerations for Arab/Middle Eastern consumers

Skin pigmentation such as dark spots and dark under-eye circles are key concerns

- Under-eye circles are more apparent in people with olive-toned skin.

- Acne and dull skin tone are also key considerations for this consumer group.

Future immigration

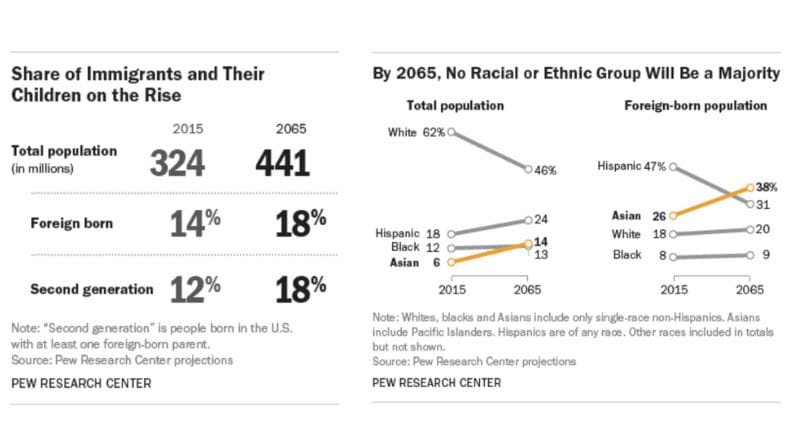

According to Pew Research Center, future immigration will change the face of America in 2065, with no racial or ethnic majority group taking the place of today’s white majority.

Projections from Pew Research Center estimates that by 2065 there will be 441 million Americans with 78 million immigrants and 81 million will be people born in the US to immigrant parents.

The U.S. Census Bureau notes that the percentage of people who reported multiple races has increased more than any other single-race group, from 2.9% of the population (9 million people) in 2010 to 10.2% of the population (33.8 million people) in 2020.

As the world becomes more diverse, there is a huge opportunity for beauty brands to develop more inclusive and diverse products that caters for specific needs as well as different skin tones and hair textures.

Key Takeaways

- As the global population becomes more diverse and the number of multiracial consumers rises, beauty brands and retailers must consider the diverse beauty needs such as more varied skin tones and hair textures in the future when developing new products.

- Beauty companies are addressing the huge R&D gap in serving the needs of people with melanin-rich skin by investing in more inclusive dermatology research that focuses on darker skin tones to promote greater inclusivity in the skincare category. This has been a long time coming and it's great to see brands finally doing this.

- Make beauty more accessible for people of colour. There is a need to increase product availability as Black consumers find it difficult to source products that meet their needs at high street retailers and when they do find the product, it is often out of stock.

- Understanding the different skin needs and concerns for people of colour is important when developing new products. Think about co-creating products with people of colour experts or real customers in the community as this will ensure your products appeal and resonate to the specific audience you are targeting.