Consumer & Sustainability Perceptions 2024: Western Europe

Our Consumer & Sustainability Perceptions 2024 report is part of a series of reports that explores how consumers view beauty and sustainability around the globe.

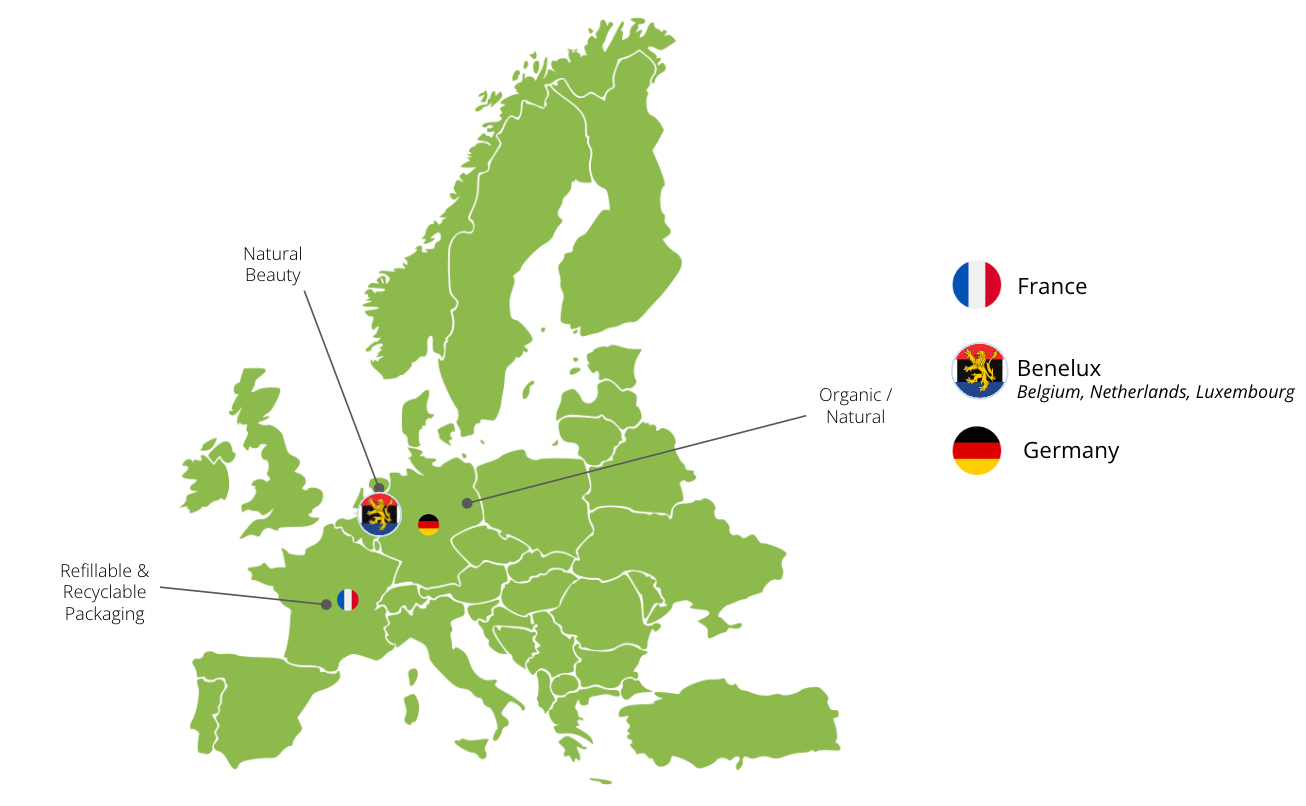

This report focuses on Germany and France. It includes consumer data and insights as well as highlights local beauty brands that are innovating in the beauty sustainability space.

Our Consumer & Sustainability Perceptions 2024 report is released in eight parts covering different regions around the world:

- Latin America - HERE

- Asia-Pacific - HERE + Malaysia - HERE

- UK & Northern Europe - HERE

- Southern Europe HERE

- Western Europe - (below article) HERE

- Central & Eastern Europe - coming soon

- North America - coming soon

- Middle East & Africa - coming soon

Sustainable Initiatives & Priorities: Snapshot

Regions:

Western Europe

The key markets covered in this report:

France

Market Insights

Economy

- According to INSEE, with 68,37 Millions people, there is a general inflation of + 2,2% in 2024 (as of May 2024), while hygiene and beauty product prices have increased by +8% over the period (Cosmed).

- French people are spending carefully, and household consumption keep decreasing by an average of 0.8%.

- 39% of French consumers declared a desire to decrease the consumption of beauty and hygiene products in 2024 (Cosmed), compared to 64% for clothing items.

Culture

- A recent survey by Kantar Media reveals that the advertising investment in CSR has decreased in the last year, and communications tend to be more focused on Corporate CSR rather than product sustainability. This can be explained by the risk of GreenWashing on product Specific claims.

- L’Oréal, one of the biggest brands in the world, is French, and is focusing on Beauty. Beauty is part of the culture in France, and less stigmatised as “superficial outlook”.

Beauty

- While the visibility of skincare products is constantly booming via the web, there is a somewhat constant decline in makeup.

Consumers want effective products, and want details on the product origins (26%), the ingredients and its advantages.

- Consumers favour products with specific active ingredients (51%) such as hyaluronic acid, retinol, vitamin C, etc. and are often (30%) ready to spend more for better efficiency or proven effectiveness.

- Long term results are also at the center of consumers expectations (40% are primarily looking for long-term effects, and 21% for long-lasting products).

Regulations

- France has released the Climate Law in 2021 (AGEC - Anti-Gaspillage et Économie Circulaire) to push businesses and consumers to reduce waste (get out of single use plastic, better inform consumers, fight against waste and for solidarity reuse, act against planned obsolescence, produce better).

France aims to reach Carbon Neutrality by 2050 (in 30 years time).

Consumer Sustainability Perceptions

- According to this IFOP survey, consumer motivations include helping to maintain jobs and supporting French businesses (Cosmed)

- 92% of French people say they favour geographical origin in their purchases

- 58% of French people consider products made in France to be a priority criterion

- 74% of French people trust the made in France mark

- Environmental damage remains on the top position on online wording (Cosmed) after daily routine and specific skin problems.

- Omnipresence of plastic in the environment and in the body, caused in particular by the cosmetics industry.

- Skin care prices: Lidl's mix of quality, ecological awareness and affordable prices has conquered the skin care market, attracting demanding French customers who want quality without high prices.

- Mention of a chemical plant located in Salindres (30), whose pollutants can have harmful effects on human health and the environment.

- LOréal has also pledged sustainability commitment for 2030 (L’Oréal for the Future) with effective targets to Fight Climate Change, Manage Water Sustainably, Respect Biodiversity, Preserve Natural Resources. And is supporting with environmental claims on some communications which influences the consumers perceptions towards more sustainable products.

- A number of consortiums have birthed in France, in the beauty industry, to help find solutions. Pharma-Recharge (Pierre-Fabre, Lab Expanscience, etc), Eco Beauty Score (Quantis, L’Oréal, Unilever, etc.), We don’t need roads - refillable beauty consortium, TRASCE ( Fébéa, Chanel, Clarins, L’Occitane, etc.), and more.

- Soon, product will be mark with an environmental index (similar to energy index) from A to G for instance further influencing the market towards more sustainable products.

- According to Kantar (2022), the % of eco-actives has decreased globally, except in France and Columbia following a local market with consistent media coverage related to recycling or other environmental topics pushed by governments.

Sustainable Local Beauty Brands

L'Occitane

The brand always had a sustainability ethos. In 1976, deposit system for its glass packaging.

Today:

- Elimination of plastic cellophane around all products - effective since 2022

- Replacement of all plastic spatulas and testers with stainless steel

- Transformation of the testers and spatulas into cardboard material

- Removal of all unnecessary plastics such as inserts in packaging (now in cardboard or moulded cellulose.)

L'Occitane has also upgraded its best seller "Karité hand cream" for a more sustainable tube, since January 2024, using the Green Leaf by Albéa, a fully recyclable tube. Loin d’être une innovation anecdotique, ce changement change la donne et nous permet d’augmenter de 5% la recyclabilité au global de nos packaging. "Far from being an anecdotal innovation, this change is a game-changer, enabling us to increase the overall recyclability of our packaging by 5%." expresses David Bayard, Head of R&D packaging at L'Occitane.

"This is the culmination of 2 years' work by our packaging teams with our supplier Albéa to revolutionise the small format of our most iconic packaging, while retaining its most recognisable features for our consumers: gouache shape, octagonal closure system.... We value consumer acceptance, and it was a real challenge to retain the iconic style of this design so consumers will keep using it while reducing their impact," adds Bayard.

Guerlain

Guerlain has been offering refillable lipsticks and perfume for a while now. It has also promoted a more transparent business model with the platform BeeRespect, detailing the sourcing and information on its packaging. Since 2011 Guerlain has been working on this since 2011 through its “Guerlain for Bees Conservation Programme”. In 2021, Guerlain became one of the first luxury houses to become a member of the UEBT (Union for Ethical BioTrade) and initiated a verification process for each of its fifty emblematic natural ingredient chains, such as honeys, orchids and Guerlinade fragrance materials.

Launched in 2022, Eclo Beauty is a 100% natural makeup line focused on regenerative sourcing following a two years development.

Eclo was initially launched in France on Ulule with + 3000% of the target and has been available in beauty retail stores in France since July 2022. The brand is also available in Direct to Consumer (DTC) through their website.

The brand is focused on regenerative sourcing. The approach of Regenerative agriculture offers a sustainable and promising alternative to conventional farming methods which focuses on soil regeneration, preserving biodiversity, water retention and long-term sustainability.

Pharma-Recharge: Launched in June 2023, the pharma-recharge initiative is led by five brands, which are mainly distributed in pharmacies. With Garancia (Unilever Prestige), Bioderma (NAOS), Pierre Fabre, La Rosée and Mustela (Laboratoires Expanscience), the initiative intends to release a refillable beauty format accessible to all in the french extensive pharmacy network in France.

The consortium was first launched in October 2022, with a single objective of boosting refillable beauty solution in the market, and the machine was released less than a year later.

Marketing & Retail Insights

- The French market is experiencing a sharp rise in demand for pharmaceutical products, with a strong focus on skincare (+17% in sales), compare to other segment which have been in decrease (-7% Mass, -6% prestige, - 7% para-pharmacie in supermarkets).

- There has been a decline in the purchase of lipstick and foundation products due to a shift towards products with lighter coverage. There is a strong influence from the search for naturalness. So a boost for powders, tinted creams, lip tints and glosses. A skinification trend boosted by the influence of social networks.

- E-commerce is a major player in market growth. Buyers are constantly on the lookout for bargains and control over their wallets. The market is witnessing the birth and constant growth of second-hand goods. The main player is Vinted. Stores are also creating buy-back zones.

- Almost all new fragrance launched on the market are now in refill system with a screw pump. Hermes has moved all its fragrance to refillable, so has Guerlain, etc.

- Pharma Recharge = the refillable stations in french pharmacies is now expanding in Paris and nationally.

- The regulation also imposes a quota for the implementation of refill systems in stores. By January 2030, all supermarkets with a size of more than 400 sqm will need to implement refill station in at least 20% of the sales area (Article 23 in AGEC Law).

- Product Manufacturer must also implement a % of refill product into their portfolio according to their turnover. For instance a company that has more than 50M euros turnover must ensure 5% of its products are refillable by 2023, 6% by 2024 or 7% by 2025 for instance.

Action Points - FRANCE

- French Consumers want sustainability but do not want to compromise on convenience of efficacy. So they want innovations and sustainability at the same level.

- The French paradox: Pioneering the refill movement, but reuse of household packaging remains less than 1%, while the target to be achieved is 10% in 2027 (one of the lowest in Europe - Article from LeMonde - June 2023).

- With the worry on price, sustainable innovation must remains cost effective for consumers. People were ready to pay more for sustainable products, this is not true anymore.

Germany

Market Insights

Economy

- The German economy was struggling in 2023, with the country’s GDP dropping 0.3% points. The consumer climate in 2024 so far is equally sluggish: consumer uncertainty and low confidence in Germany’s economic development is holding back the willingness to buy.

Climate & Environment

Consumers in Germany are very environmentally conscious. The country has a long-standing history of political and grassroots eco activism

- In 1980, a wide number of environmental, peace and human rights activist movements unified in the Green Party - which is still an active party in parliament today.

- One of the first European countries to introduce packaging and recycling laws for food and packaging retailers and manufacturers (1991) as well as a deposit system for glass and plastic bottles (2003).

- Waste recycling/separation for private households first began in the early 1980s. The last few consumer generations have grown up with this kind of environmental awareness.

Beauty

With annual turnover of around 1.43 billion Euro for certified organic beauty, Germany is the largest and most mature organic beauty market in Europe and the second-biggest worldwide after the US

- In Germany, certified organic beauty is mainstream: Every third consumer is buying organic cosmetics and the organic beauty sector accounts for 10% of the entire German beauty & personal care market (2023: 15.853 billion euro).

- In 2021, 14.8% of organic beauty users were aged between 20 and 29 years. While the average organic beauty user in Germany is female, well-educated and financially stable, the men's care category – driven by GenZ and Millennial men – has also been growing in recent years.

- 80% of organic beauty turnover in Germany is through the country’s highly competitive drugstore channel, especially the two biggest chains dm and Rossmann which between them operate more than 4,000 stores nationwide.

Consumer Sustainability Perceptions

- A 2022 study about environmental awareness found that for 57% of Germans, the protection of climate and environment is a very important political issue. Young adults in particular see sustainability as a holistic issue.

- According to a Bertelsmann Stiftung 2022 poll of 16-30 year olds, 96% said that sustainability meant preserving natural resources and the climate and 91% felt that sustainable decisions need to take into account the individual effects on the climate change.

According to GfK's most recent Sustainability Index, 67% of consumers are willing to pay more for sustainable consumers goods (October 2023: 64%)

- German consumers are well-educated, highly critical and organic product seals play a key role in their purchase decision. "Vegan" is a very common sustainable food and beauty product claim in Germany – for many consumers, "vegan" trumps "organic".

- According to a 2021 study by pwc, 24% of German food shoppers buy more organic than conventional products (2017: 14%) and 59% of consumers polled said that seals affect their natural products purchase decision (2017: 49%).

Supply chain transparency is also becoming important to natural beauty consumers: 57% of Germans research where ingredients are sourced (Mintel, December 2023)

- According to a retail study by market strategists Simon Kucher, 19% of German consumers will buy fewer products if sustainable alternatives aren't available. 43% of consumers would be happy to pay more for sustainable products especially in beauty and fashion. However, at the same time consumers are particularly suspicious of greenwashing in these two markets (fashion: 45%, beauty: 41%).

- Sustainable packaging is another key concern for German consumers. A 2022 Simon Kucher study found that 72% of Germans would be willing to pay more for sustainably packaged products.

Sustainable Local Beauty Brands

Alverde

Drugstore retailer dm's certified organic own label brand. Launched more than 30 years ago; massive brand recognition thanks to an extensive portfolio across all product categories. During the pandemic, dm launched its first climate positive product range in the Alverde brand.

I+M Naturkosmetik

An organic pioneer brand from Berlin, I+M Naturkosmetik launched in 1978. Strong political agenda, regular Fair Editions (limited edition products) that benefit local and international charities (queer, environment, human rights); many of their international ingredients are fair sourced.

NKM

Regional DTC/community-based brand from Munich, launched in 2019. Classic kitchen table brand; products are still locally produced. In 2022, nkm launched a reusable packaging concept where consumers can send back 10 empty packs free of charge and receive a 10% discount on their next purchase.

Farm Loves Face

Science-meets-nature vegan brand launched in early 2024 by drugstore makeup manufacturer Cosnova. Focus is on regional ingredients; although some primary packaging components are still plastic, bottles and jars are made from glass. High-tech ingredients combined with classic European or German plant extracts such as kale and sea buckthorn.

Marketing & Retail Insights

- As German eco consumers are well-educated and increasingly critical of unsubstantiated brand claims – 57% of Germans regard sustainability initiatives by large companies as greenwashing – beauty brands are learning to tread lightly.

- During the pandemic, climate-neutrality became a prominent brand claim in food and beauty, with "klimaneutral" stickers quickly appearing at POS and on product packaging. The backlash amongst media and the sustainably minded public was inevitable: Following critical articles in both mainstream media (Spiegel, Zeit, ZDF) and environmental publications, the "climate neutrality" claim quickly became regarded as a prime example of corporate greenwashing.

- A 2023 lawsuit by environmental and consumer protection non-profit Deutsche Umwelthilfe forced drugstore retailer dm to abandon the "klimaneutral" or "umweltneutral" (environmentally neutral) claim on certain own label products.

- Germany's big drugstore retailers are also devoting more resources to consumer education: The dm chain's website has detailed information as well as pros and cons about the different packaging materials and concepts.

- Drugstore chain Rossmann, another early adopter of "klimaneutral" claims across its own label brands, also announced that it would no longer advertise climate neutrality as the term had become tarnished in the eyes of many consumers.

- At the time of writing, German confectionery brand Katjes is being sued by one of Germany's regional Centres for Protection against Unfair Competition for claiming that its entire production was "klimaneutral". The lawsuit is currently being held in Germany's Federal Supreme Court.

- Newly-launched brands are now focusing on less controversial sustainable brand claims. Drugstore beauty brand No Planet B, for example, made sure to prominently highlight its upcycled ingredients concept in the brand's recent relaunch, while recently launched certified organic beauty brand Bio Vegane Legit Beauty focused on aspects such as the percentage of recycled materials in the packaging and the fact that the entire production process takes place in Germany.

Action Points - GERMANY

- Social awareness: topics like climate, environment and sustainability are strongly anchored in Germany's social awareness thanks to a comprehensive legal framework governing sustainability aspects such as recycling, packaging and organic agriculture.

- Certified organic: Germany's mature certified organic beauty market has accustomed consumers to a wide choice of very affordable and widely available brands and products.

- Transparency is key: Germany consumers are sophisticated, well-educated and very critical of greenwashing initiatives so transparency in terms of brand and product marketing is crucial in getting them to engage with brands.

- Holistic view point: younger consumers in Germany view sustainability as a holistic concept including aspects such as eco-friendly packaging, ethical ingredients sourcing, supply chain transparency and the personal CO2 footprint.