Consumer & Sustainability Perceptions 2024: LATAM

This report will outline how four key markets (Argentina, Brazil, Colombia and Mexico) across the LATAM region are responding to climate change in the face of economic uncertainty.

An overview of consumers’ beauty buying behaviours and some of the leading sustainable brands will be analysed with a view to understanding the perception of sustainability within the beauty category across Latin America.

This report was created in collaboration with beauty intelligence & ideation agency In-Trend.

Overview

LATAM Key Insights:

- Rich in natural resources and one of the most biodiverse regions in the world with a high impact risk from climate change.

- Consumer efforts to shop sustainably are under pressure as post-pandemic economic and social pressures are making them more price-sensitive.

- Water scarcity and climate change are the top concerns, shortly followed by water waste and water pollution.

- Waste management is a tangible issue: ‘El Basurero’ is a neighbourhood-sized garbage dump - this issue encourages refillables, reusable packaging and recycling among younger generations.

There is growing eco-positivity across the region - 61% feel they can make a difference with action (71% in Central America)

- However, it is significant to note the value-action gap is more prevalent in times of economic uncertainty. The recycling rate is still low across the region (0-15%).

- There is an emerging interest in circular solutions for the beauty industry, particularly in Chile and Costa Rica.

- Packaging manufacturers are increasingly exploring sustainable solutions such as C-Pack in Brazil.

- Besides Brazil, Mexico and Chile, Inkwood Research analysts note that Colombia and Argentina are “enjoying growing beauty sales, boosted by an expanding middle class and a cultural fascination with looking good”.

- Mexico, Colombia and Brazil sit in 13th, 21st and 35th on the global sustainability index – significantly higher than the USA (197th) but in line with European countries in the top 50 (UK, Italy, France, Spain, Germany and more).

Sustainable Initiatives & Priorities: Snapshot

Regions: LATAM

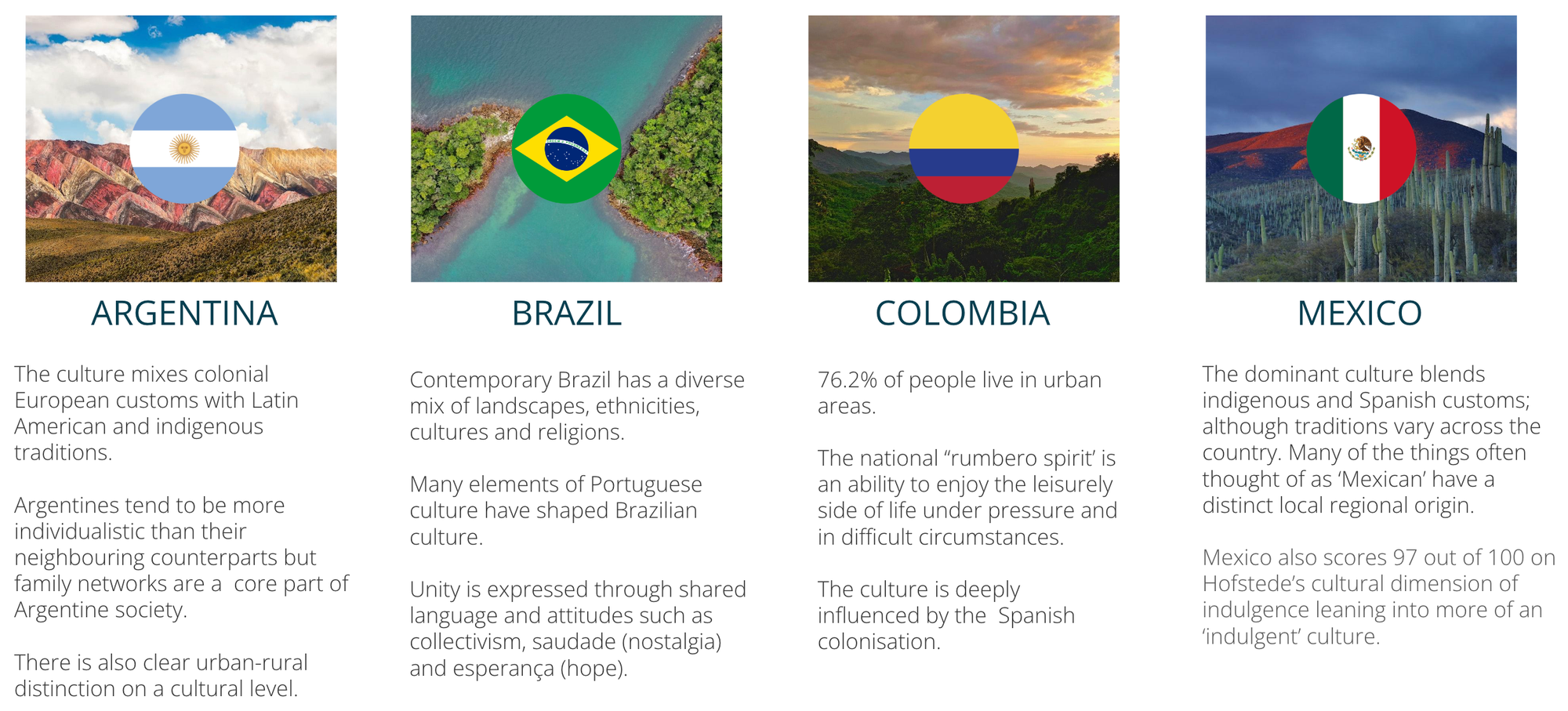

Four key markets from the LATAM region will be covered in this report:

Some of the key barriers to sustainable consumption & adoption in LATAM:

- Inflation & cost of living across region: largest impact on consumer ability to shop sustainably.

- Lack of trust: political corruption + fractious leadership in Argentina, Venezuela, Brazil. Consumers unable to look to governments for sustainable action and leadership.

- Trade barriers & high import and export costs in Brazil and Argentina creates local focus but limits a global view on sustainable beauty.

- High crime rates in Mexico, Colombia, Venezuela: means de-prioritisation of climate concerns and sustainable consumption habits.

Brazil

Market & Consumer Insights

Economy

- Financial conditions are easing: supporting future consumer spending in Brazil.

Climate & Sustainability

- Rich diversity of ecosystems: including the Amazon forest and is famed for its significant biodiversity.

- As the 5th largest country in the world, is home to over a third of the Earth’s tropical forests.

Beauty

- Growth in beauty & personal care is strong: expected to grow from USD 31.31 billion in 2023 to USD 41.60 billion by 2028.

53% of respondents in Brazil were interested in natural beauty products as of September 2019 (Statista)

- 31% believe products manufactured with organic and natural ingredients are more effective than the ones using chemicals (Statista).

- Brazil is a protectionist market with local sourcing playing a significant role in the beauty industry.

- Increase in specialised and derma-focused skincare. The rise in skin-related problems has led to the demand for more targeted products across the region.

- Environmental damage to skin is a growing concern: urban pollution levels are positioning consumers towards protective personal care cosmetics to protect their skin from environmental damage and a focus on less harmful + natural ingredients.

Sustainability Perceptions

- Strong climate change awareness: there is a consensus on climate change in Brazil with 96% of Brazilians agreeing that climate change is happening and 77% identifying human activity as its primary cause.

About eight in ten Brazilians (81%) said the issue of climate change is “very important”

- 77% of Brazilians value environmental protection over economic growth: from a younger and centre-left leaning pool of respondents.

- Deforestation and forest fires are a primary concern for the region.

- Brazilian products are globally regarded for their natural and organic formulations, which are often associated with sustainable practices and cruelty-free production.

Trust and transparency: 80% of Brazilian consumers believe brands need to do more to prove their ethical claims are trustworthy (Mintel)

- There is strong support for science-backed beauty, particularly amongst men.

- Clean hair care is a priority for parents.

Local Sustainable Beauty Brands

L'Occitane au Bresil

This is the only local arm of L’Occitane globally and has strong presence in the region. Combines French heritage with Brazilian DNA through natural local ingredient sourcing.

Bergamia

This newer brand has a smaller following but shows the direction clean beauty brands are heading in the region. Natural and organic biotechnology company with B Corp accreditation.

Rio Skin Lab

Dermocosmetic bio-innovation brand targeting Brazilian skin. Clear communication of science across channels, learning into transparency. Strong credentials including B Corp certification and focuses on building a community around sustainable, safe and scientific values.

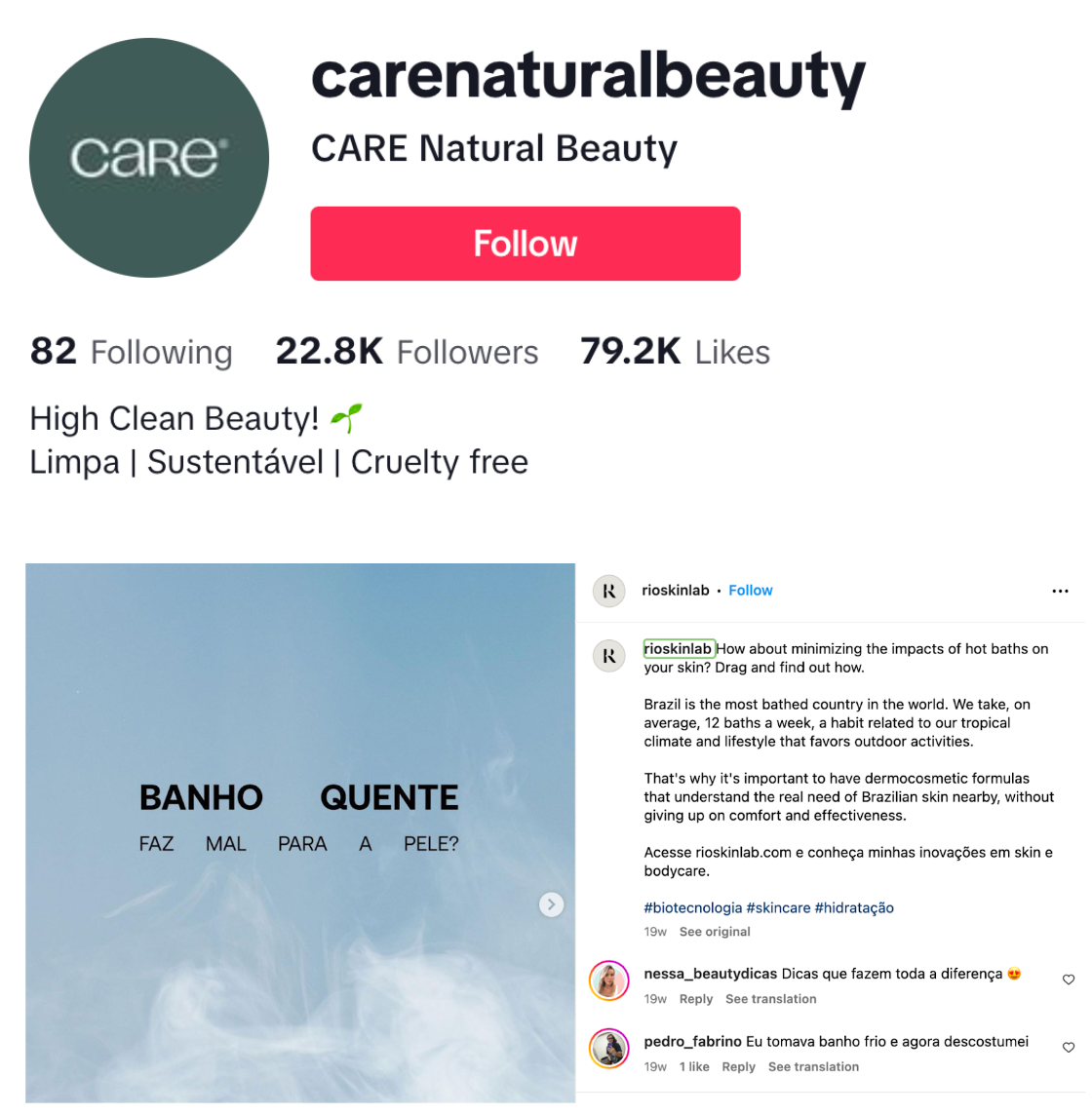

Care Natural Beauty

Skincare and make-up brand positioned as 100% clean and transparent. Family focus in socials promoting safety of ingredient and products, making it popular with audience.

Marketing Insights

- Brand communications are increasingly digitised and focused on sustainability.

- Local skincare brands are marketing their products in reflection of the vast range of Brazilian skin tones and ensuing specificities of the country’s beauty routines.

- Formulations with active ingredients sourced from an unrivalled local biodiversity also create strong marketing messages.

- Local brands such as Creamy and Simply Organic communicate a more minimalist and conscious beauty routine whilst educating their communities on ingredient and routine.

- Care Natural Organic uses social channels to share clean beauty credentials, ingredients and cruelty-free ethos.

Colombia

Market & Consumer Insights

Economy

- Colombia is one of the top economic performers in Latin America: the country has committed to balancing growth with delivering environmental, climate and sustainability targets.

Climate & Sustainability

- The country is extremely vulnerable to climate change: the coastal and mountain ecosystems directly benefit 80% of the population.

- A mega diverse region: Colombia is home to nearly 10% of the world’s known species and is aware that it needs to balance economic growth with environmental conservation.

- Government-led measures: There is also a local green bond market, and a green taxonomy and has banned single use plastics.

- Integrated sustainability measures: ESG factors built into the guidelines for the financial sector and infrastructure projects.

Beauty

- Significant growth in cosmetics market: expected to grow from USD 241.15 million in 2023 to USD 358.28 million by 2028, at a CAGR of 8.24% 2023-2028.

Rising consumer interest in colour cosmetics products: one of the fastest-growing in the LATAM cosmetics industry.

- The Colombian cosmetics industry is committing to sustainability by seeking out and implementing sustainable raw materials.

Sustainability Perceptions

- Awareness of climate change is relatively high across the region: witnessed largely in temperature rise and decrease in rainfall.

- Deforestation, air pollution and waste management are viewed as the primary causes of climate change.

Sustainability is a greater concern for younger and more progressive consumers while it is noted that it is not a huge regional priority.

- Values-action gap is significant: while awareness is high, individual action is less prominent with consumers looking to government for guidance.

- Colombians aim to contribute to the mitigation of climate change through their purchasing behaviour and tend to care for natural systems.

- Consumers believe decision-makers, such as marketing specialists should continue to promote sustainable consumption via corporate social responsibility campaigns, and the development of new eco-friendly products that are more affordable to the population.

Circularity and sustainable packaging are top priorities. Colombia launched a plastics pact this year, tackling the environmental impacts of packaging waste and support international work developing a circular economy for plastics

- Green consumerism and climate action is significant: Kantar notes that Eco-Active consumer group Colombia was the only region outside of France with growth in 2022.

- Local lifestyle media is covering natural ingredients, particularly for haircare and positioning natural + anti-ageing as the key beauty trends for next year.

Local Sustainable Beauty Brands

Vibes

Local leaders in clean formulations, refillables, non-invasive production methods and biodegradable packaging. Sustainability commitment and story is outlined on its website. Vibes have the most significant following among local sustainable brands.

Mind Skincare

The brand promise to reduce the carbon footprint of production and create a culture of environmental awareness for their consumers. Sustainable packaging, and cruelty-free products are all communicated.

Loto Del Sur

Plant-based beauty and fragrance products made from local Latin America flora, including vegetable soaps, candles, body care and lip balms. Engaged audience leave positive comments about product and packaging.

Marketing Insights

- Brands such as Vibes are tapping into marketing innovations with AI-generated campaigns to creatively communicate their sustainable packaging messaging.

- Brands are also communicating clean credentials on TikTok with brand personality to connect with their engaged younger audience such as Vibes.

- Blog content and community education is also popular with brands sharing ingredient efficacy, sustainable lifestyle inspiration and community building via websites.

- Heritage storytelling is used at Loto del Sur to engage community and inspire consumers and brand fans alike.

Mexico

Economy

- GDP growth is high in Mexico: The GDP grew 3.7% year-over-year in the first half of 2023 and is ranked 5th in annual GDP growth of G20 countries.

- The Mexican market is more interested in a “low price” than in a “sustainable product”. Economic status is a key driver. Consumers in states such as Chiapas, Oaxaca and Guerrero do not have the same purchasing power as people in the north states such as Nuevo León and Coahuila.

Climate & Sustainability

- The country is a bio-cultural stronghold with a rich natural heritage protected by indigenous peoples and local communities.

- ESG (Environmental, Social and Governance) is not yet integrated into systems: there is no law or regulation defining what ESG is currently.

Beauty

- Growth is slower in the beauty and personal care space in Mexico: it is projected to grow from USD 8.83 billion in 2023 to USD 10.90 billion by 2028, at a CAGR of 4.30% up to 2028.

- Consumer spend is relatively low: Mexican consumers spend roughly USD 215 p.a. on cosmetics and personal care products.

- The market is currently dominated by skincare. Mordor Intelligence cites increasing demand for natural or organic and cruelty-free cosmetic products and eco-friendly packaging designs, which is expected to enhance the country's market further.

The natural cosmetics market is growing: it amounts to US$164.90m in 2023 and is expected to grow annually by 4.29%

- However, 58% of Mexicans consider sustainable products to be too expensive and 68% affirm they only take actions in favour of the environment when they are allowed to have financial savings.

Sustainability Perceptions

- Green consumerism is on the rise in the region. A 2022 survey by the Mexican Chamber of Commerce found that 75% of Mexicans believe that sustainability is important, and 63% are willing to pay more for sustainable products and services.

- Mexico is a relatively young nation with a median age of 28, increasing the awareness and action regarding climate concern and need for sustainable solutions.

Refillable packaging is a growing priority. A refillable shampoo initiative from Unilever proved popular in Mexico City in 2020.

- Sustainable packaging is also a priority and opportunity: Mexico is one of the countries leading the sustainable packaging movement.

- The market volume of sustainable packaging in Mexico reached 4.3 million metric tonnes in 2021, recording a CAGR of 3.8% between 2017 and 2021, and an increase of 1.5% year-over-year.

- Beauty brands beginning to align behind ‘Conscious Beauty’.

Local Sustainable Beauty Brands

Cyzone

Cruelty-free make-up brand from Belcorp, a network and foundation supporting female empowerment and entrepreneurship across LATAM. Direct selling model and huge popularity with 1.4 million followers on Instagram.

Ahal

Clean skincare and organic make-up made in Mexico combining national herbalism with scientific technology. They promote biodegradable ingredients and sustainable packaging.

Raw Apothecary

Performance-focused skincare with 100% natural ingredients. Launched in 2017 in response to consumer need for non-toxic beauty.

Im Natural

Cosmetic products enriched with natural ingredients. The brand shares natural ingredients’ benefits with its consumers.

Marketing Insights

- Community-centric communication is popular amongst clean beauty brands in the region.

- Educational blogs and Spotify links connect and build the sustainable consumption community at Ahal.

- Ingredient transparency is popular amongst audiences on Instagram.

- A more youthful Gen Z - Alpha lens, Raw Apothecary also incorporates popular beauty memes into feeds.

- Know-how is strongly communicated via ‘skin tests’ and positive customer feedback.

Argentina

Economy

- The macroeconomic situation has deteriorated: drought has reduced agricultural exports and caused negative effects on GDP and tax revenues.

- Consumers are looking for multifunctional and value products that are also natural and beneficial for the skin with premium attributes like anti-ageing, whitening and moisturising at a lower cost.

Climate & Sustainability

- Argentina has a diverse range of eco-regions: the country covers most of the southern part of the continent.

- Climate change and agricultural expansion pose a great threat: droughts, floods and wildfires are rapidly degrading habitats.

Beauty

- Beauty and personal care market growth is slowest in this region. The skincare market is led by facial care and is projected to grow at a CAGR of more than 29%.

- Multifunctional skincare products are most popular: protection from sun exposure and other environmental aggressors while promoting lighter skin tones are preferred.

The cosmetic industry is also becoming more environmentally conscious although 42% of Argentine consumers cite cost as biggest barrier to using eco-friendly products

- While there is less sustainable local brand activity in the region, Novachem is a renowned Argentine sustainable cosmetic actives innovator, recently acquired by German specialty chemical company, Evonik.

Sustainability Perceptions

- Sustainability perception in Argentina is generally positive: despite the negative macroeconomic scenario there is a high level of public awareness and concern about environmental issues.

- Consumers perceive sustainability as consisting primarily of the environmental with less awareness of the social and economic dimensions.

Younger generations are most concerned. A recent study by the University of Teramo found that 87.9% of Argentine Zoomers (Gen Z) are concerned about the health of the planet and 88.8% are concerned about unsustainable production methods

- Natural and organic beauty is a priority. Argentinian consumers are increasingly looking for natural and organic beauty products that are free of harmful chemicals.

- Refillable packaging options are also important: this is evident in Instagram comments replying to local sustainable brands.

- Consumers are seeking eco-friendly beauty products: there is greater awareness of the impact of their purchases on the environment.

Local Sustainable Beauty Brands

Natura

Natura is a B Corp certified multi-brand retailer with 735K followers on Instagram. They promote vegan and cruelty-free products and 'bio-innovation'. A Brazilian heritage beauty company with significant presence in Argentina.

Aname Vio

Local brand that exports to the US. Aname Vio focus on natural products and ingredient language with a strong Argentine heritage in messaging.

ACF

The 3 year-old company is a vegan and cruelty-free skincare brand with fragrance and haircare sister brands. One of the few brands offering refillables and promoting the service on Instagram.

Regina Cosmetics

Skincare and cosmetics brand committed to natural ingredients and sustainable packaging. They have an active community on social media but fans tend to comment more on aesthetic than sustainability.

Marketing Insights

- Some UGC and influencer content is shared by local clean beauty brands such as ACF across Instagram Youtube and TikTok.

- Vegan and /or clean credentials are mostly shared in Instagram bios but there is less focus or clarification in the actual content shared.

- Beauty how-tos have a GRWM (get ready with me) quality at Regina Cosmetics.

- There is also influencer and MUA (make-up artist) content shared with tips although little mention of any sustainable attributes of the brand or product(Regina Cosmetics).

Key Takeaways

- Economic uncertainty in the region, especially in Argentina, is challenging the values-action gap when it comes to sustainable purchasing decisions.

- Sustainability perception and eco-positivity is greatest in Colombia, Brazil & Mexico due to comparably better economic conditions.

- The clean beauty brand landscape is populated in Brazil but there is a new generation of independent brands emerging, rooted in environmental and social community.

- There is significant opportunity in Argentina for value-sensitive offerings and multi-functionality within the clean beauty space.

- Younger consumers are the key target with brands across the region communicating to the cohort via community-centric video content and educational blogs.