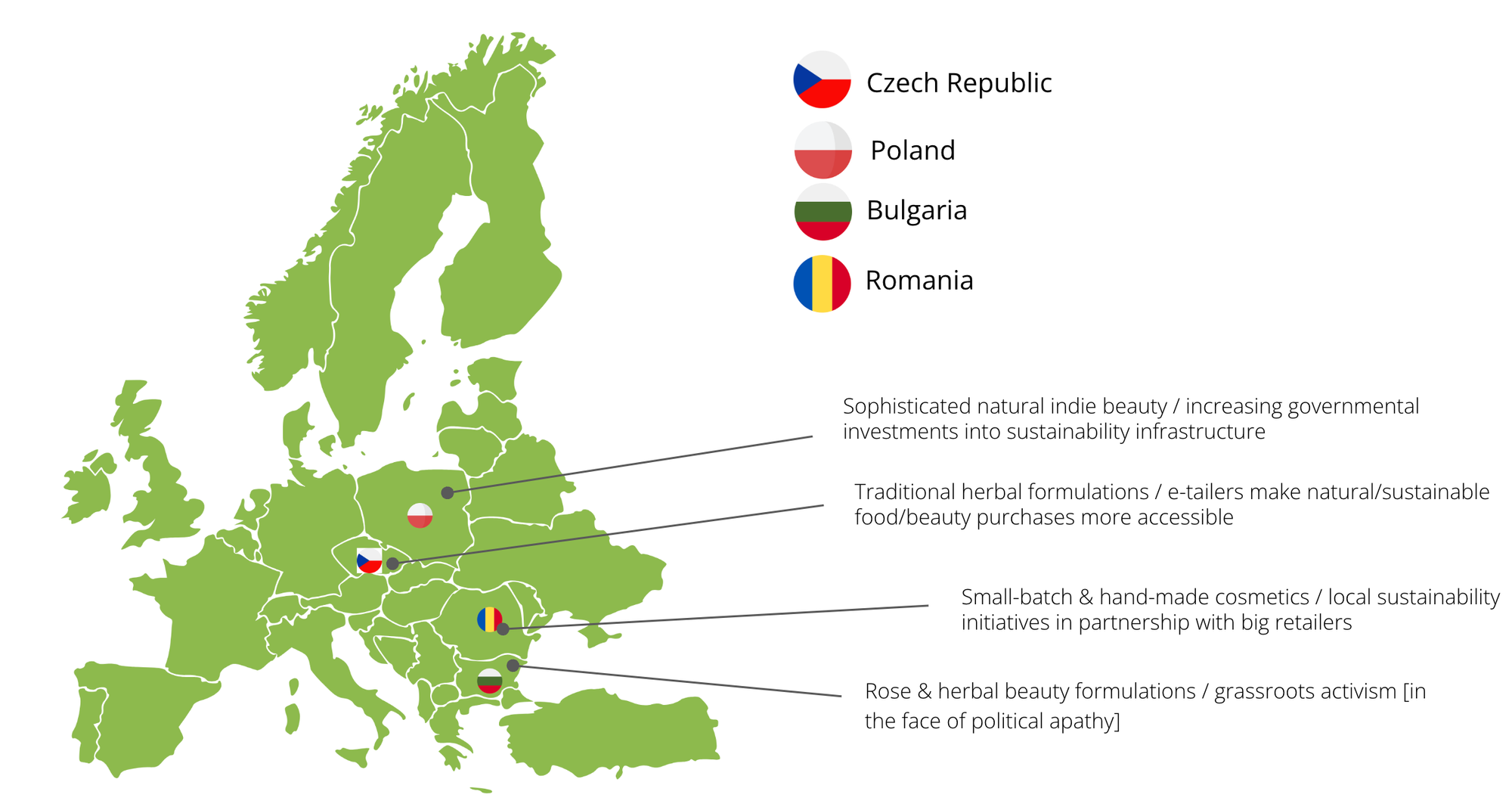

Consumer & Sustainability Perceptions 2024: Central & Eastern Europe

Our Consumer & Sustainability Perceptions 2024 report is part of a series of reports that explores how consumers view beauty and sustainability around the globe.

This report focuses on four countries: Bulgaria, Romania, Czech Republic and Poland, including some insights about Hungary. It includes consumer data and insights as well as highlights local beauty brands that are innovating in the beauty sustainability space.

Our Consumer & Sustainability Perceptions 2024 report is released in eight parts covering different regions around the world:

- Latin America - HERE

- Asia-Pacific - HERE + Malaysia - HERE

- UK & Northern Europe - HERE

- Southern Europe HERE

- Western Europe - HERE

- Central & Eastern Europe - (below article)

- North America - coming soon

- Middle East & Africa - coming soon

Sustainable Initiatives & Priorities: Snapshot

Regions:

Central & Eastern Europe

The key markets covered in this report:

Market Insights

The four countries are very different:

- Poland is the largest country in the quartet (36.8 million (m) people) followed by Romania with 19.05m and the Czech Republic with 10.67m citizens. Hungary has a population of 9.70 m.

- Bulgaria (6.5m) is the smallest market.

- Poland and the Czech Republic joined the EU in 2004, Bulgaria and Romania followed in 2007.

Poland and the Czech Republic are amongst the most prosperous and stable countries in this section while Romania and in particular Bulgaria suffer from significant public sector corruption and political/economic instability. In 2023, Romania received the third-lowest EU score (46) in Transparency International’s Corruption Perceptions Index (CPI), following Bulgaria (45) and Hungary (42). The Czech Republic, on the other hand, scored 57 in 2023 while Poland received a score of 54.

Transparency International’s CPI barometer ranks 180 countries worldwide by their reported public sector corruption on a scale from 0 (highly corrupt) to 100 (no corruption, i.e. clean). The global average is 43, the Western Europe/EU average is 65. To compare, 2023 scores for Western European countries were Sweden (82), UK (71), Denmark (90), Italy (56), Germany (78).

Economy

Poland: After a sharp slowdown in 2023, economic growth is expected to rebound in 2024 (+2.8%) and growing to 3.4% in 2025; supported by strong private, as well as public consumption. Investment is set to contribute positively to growth in 2024, less than in 2023, but to accelerate in 2025. Unemployment reached 2.8% in 2023 and is set to grow to 2.9% in 2025.

Romania: thanks to higher disposable incomes which are driving private consumption, GDP growth in Romania is set to grow to 3%. Financial conditions are expected to ease and public investment to remain robust. Unemployment is expected to decline from 5.6% in 2023 to 5.5% in 2025.

In the Czech Republic: GDP is expected to grow by 1.2% in 2024 and 2.8% in 2025 as inflation is tapering off and helps restore purchasing power. Unemployment figures are set to rise from 2.6% in 2023 to 2.9% in 2025.

GDP in Bulgaria: GDP is forecast to grow by 1.9% in 2024 and 2.9% in 2025. Although private consumption growth is expected to moderate, domestic demand is set to remain the main growth driver. Unemployment reached 4.3% in 2023 and is set to drop to 4% in 2025.

Hungary is expected to see a "gradual recovery" with GDP growth forecasted to reach 2.4% in 2024 and 3.5% in 2025. This is largely driven by "strong real income growth, supported by the resilient labour market and above-inflation hikes of pensions and minimum wages in 2024, wrote the European Union on its website.

Climate & Environment

In July 2020, the EU’s Waste Management Directive came into effect. According to Eurostat data, the Czech Republic was the best-performing country in this section, with municipal recycling rates growing from 25.4% in 2014 to 43.3% in 2021.

Poland’s municipal recycling rate rose from 12% in 2012 to 40.3% in 2021 which, however, is still below the EU average of 49.6% for 2021. In order to drive forward consumer recycling and reduce the use of single-use plastic, Poland will be implementing a new Deposit Returns System from Janury 2025.

The country has also been investing into e-mobility. According to the Polish government, at the end of February 2024 there were more than 100,000 fully electric and hybrid cars registered in Poland.

Romania & Bulgaria: less developed Eastern Europe countries

While Eastern Europe has been slower to implement governmental sustainability measures than the most Western European countries, Romania and Bulgaria are lagging behind particularly badly. Both countries are underperforming in just about every sustainability category laid down by the EU sustainability directives.

A typical example are municipal waste recycling rates which actually dropped in both countries since joining the EU in 2007. According to Eurostat data, municipal recycling rates in Bulgaria reached 23.1% in 2014, then grew to 34.6% in 2017 and dropped again to 28.2% in 2021. Romania was the worst-performing country in this ranking, with a municipal recycling rate of 13.1% in 2014 which has since dropped to 11.3% in 2021.

According to the EU Commission’s Environmental Implementation Review 2022 for Bulgaria, the country is significantly lagging behind other regional EU member states. Air pollution is still high – Bulgaria’s has one of the highest rates of air pollution-related deaths in the EU – while the country’s compliance with the EU‘s urban waste water management policies is 30%, the fourth-lowest. Waste management is another problem area, as is the implementation of nature protection legislation. Circular material use actually dropped in between 2016 (4.3%) and 2021 (2.6%) and is significantly lower than the EU average of 12.8%

There are several recycling/waste management associations in Bulgaria – the first, and largest is Ecopak which began operations in 2004 – but the municipal and private waste collection/management situation is still dire. Bulgarian environmental non-profit For the Earth is working to improve municipal and individual waste recycling, organising information campaigns, conferences and workshops and collaborating with individual municipalities.

In Bulgaria, some cities/communities are better than others in terms of municipal waste collection and recycling. In 2019, the city of Svilengrad became the first city in Bulgaria to sign up for the Zero Waste Cities programme, primarily because of the motivation and involvement of the city’s administration and populace – for example, the municipality had organised direct collection of sorted waste for recycling from shops and restaurants, purchased a baling machine to better store and transport waste paper and cardboard, and installed a capacity composting facility 3000 tons per year. And the municipality of Gabrovo is currently developing a plan to prevent plastic waste in municipal building, kindergartens and public spaces.

In other cities, including the capital Sofia, things are much worse, primarily because of the competition between formal and informal waste collection. Informal waste collection is carried out by private individuals – according to For the Earth, there are some 6,000 individual waste pickers most of which are homeless/poor – and recycling associations.

The situation in Romania is similar: environmental initiatives are mostly found in the larger cities and tend to come from the grassroots level rather than being initiated or funded by the government. Sustainability initiatives like municipal/private systems for the recycling of bottles/glass or paper or consumer goods deposit/refill systems exist in some individual municipalities or within the occasional urban location, but there are no country-wide systems/infrastructure.

In Hungary, the country has faced challenges with low recycling rates and littering with less than 30% of plastic beverage containers recycled in 2022, according to the Ministry of Innovation and Technology.

In January 2024, Hungary launched the Deposit Return System (DRS) for recycling single-use drink containers. This means that all glass, metal and plastic bottles and beverage cans with a capacity of between 1 dl up to 3 litres, except for milk and milk-based beverages, must be marked and registered with deposit markings and indicate the return fee policy. Consumers pay a deposit for the bottle, which is refunded when they return the empty drink container for recycling. The country hopes to recycle over 90% of plastic drink containers by 2029.

Organic Agriculture

As the countries mentioned in this report are of very different sizes and at different socio-economic levels, figures and data for organic agriculture vary accordingly. In Romania, the demand for organic products by consumers is at a very low level compared to other Eastern European countries and Western Europe. In 2020, organic food sales in the country reached 41 million Euro, according to an academic article from 2023.

Official figures on the Bulgarian organic market are difficult to find. According to the USDA Foreign Agricultural Service’s 2022 report, in 2020, the domestic organic food market was valued at around 38million USD. However, the number of organic farmers, operators and companies declined in 2020 and so did the acreage of certified organic agriculture in Bulgaria compared to the previous years. The report also highlights the many regulatory and certification challenges facing organic farmers in Bulgaria which make organic agriculture much less appealing to new farmers.

In the Czech Republic, the government is attempting to increase the market share of organic food and beverages to 4% of the entire foods/beverage market by 2027.

According to IFOAM’s data for 2022, only 2.2% of arable land in Bulgaria was cultivated according to organic standards. For the Czech Republic, IFOAM estimates that in 2022, the percentage of organic agricultural land reached 16% . In Poland, the percentage of organic agricultural land in Poland was 3.5% in 2022 and in Romania, 4.3% of land in Romania was cultivated according to organic standards.

Culture

For Poland, the EIB study 2023/2024 found that 66% of Polish were worried about the rising cost of living followed by access to healthcare (41%) and climate change/environment (40%), with 42% of respondents saying that they trust their government to transition to low-carbon economy.

In Romania, 78% of Romanians see the rising cost of living as the top challenge – 8% higher than the EU average – followed by income inequality (46%) and climate change impact/environmental degradation (45%). Only 33% of respondents are confident in their government’s ability to carry out a transition to a low-carbon economy.

In the Czech Republic, the study found that 68% of Czech respondents worry about the rising cost of living, with political instability (36%) and climate change impact/environment (36%) tied for second place. 37% of Czech believe that their government can transition the country to a low-carbon economy.

Looking at the results for Bulgaria, 70% of Bulgarians felt the rising cost of living to be their top three concern, followed by political instability (56%) and income inequalities (42%) with climate change impacts and environmental degradation in fourth place (30%), which is 20 points below the EU average of 50%. This suggests that Bulgarian are even more concerned about political stability in their country than the other Eastern European countries in this report. Only 28% of respondents believe that their government can carry out a transition to a low carbon economy.

Hungarian consumers are becoming increasingly eco-conscious. A recent survey by the Eurobarometer found that more than eight out of ten respondents in Hungary (81% compared with the EU average of 78%) think that climate change is a very serious problem, and at least six out of ten respondents in Hungary believe that business and industry and national governments are responsible for tackling climate change.

Traditional herbal & plant remedies/ingredients

Traditional European herbal remedies/teas/foods play an important role in the consumer goods markets in the countries mentioned in this report.

Bulgaria, a comparatively small country, is one of the key suppliers for medicinal/herbal plants and raw ingredients – in many rural areas, wild-harvesting and herb gathering is still an important local industry/business. However, around 80% of the collected herbs are exported to other European countries (especially Western Europe) and the US.

Consumer Sustainability Perceptions

On the other hand, according to the EIB’s 2022/2023 Climate Survey study, 69% of Bulgarians are in favour of stricter government measures to help change individual behaviour and 71% of Bulgarians say they would pay more for climate-friendly food. In Romania, results were similar: 69% of Romanians are for stricter government measures to change individual behaviour and 71% would pay more for eco-friendly food.

In Poland, agreement was a bit lower: Only 65% of respondents would be willing to pay more for climate-friendly foods and 66% were in favour of stricter government measures to change individual behaviour. Czech consumers feel very similar: 59% of Czechs want stricter government measures while 57% say they’d pay more for climate-friendly foods.

According to Euromonitor, 66% of Polish consumers try to have a positive impact on the environment through their everyday actions.

Czech Republic: A recent survey on sustainable marketing and consumer attitudes/buying behaviour of Czech consumers (2024, article was published in the WSB Journal of Business and Finance) found that although 31% said that they preferred sustainable/eco goods and services and would be willing to pay more for them, a much larger share (40% of respondents) admitted that the price/utility aspect was the most important factor for them, essentially eliminating eco goods/services from their purchasing behaviour.

However, the same study found that more than half of all respondents (52%) placed "sustainability" as one of their top three attributes when asked to chose from a list (price, quality, convenience, branding, brand experience, product/brand reputation) and for a further 29%, sustainability was not part of their main purchase criterions but rather an additional purchase factor.

And a recent Czech study (Chtytře a udržitelně) about the popularity of recycled clothing/re-use centres conducted by the universities in Prague and Brno found that while consumers say that they’d prefer to shop sustainably when buying fashion, for example, the key purchase driver remains the price.

Romania: According to an ethical consumer study by Romanian market researcher MKOR, 38% of Romanian consumers are aware of the impact their consumption behaviour/purchasing goods and services has on the environment, with 56% more likely to be undecided as far as this issue is concerned. However, the study also highlights that 4 out of 10 indecisive consumers contribute to environmental protection through their daily habits.

The demographic profile of the ethical consumer in Romania is similar to that in other countries – primarily female, well-educated (45% have a higher education degree), aged around 40 years/from the Millennials generation, likely to be a parent and living in an urban area (79%).

Beauty

Bulgaria: The Bulgarian natural beauty market is estimated to reach 1.96m Euro in 2024, with an anticipated growth rate of 9.67% CAGR by 2029.

In terms of beauty and ingredients, Bulgaria is most famous for its rose cosmetics. The country is the largest international producer of rose oil and rose water and its Rose Valley is one of the top tourist attractions in the country. Traditionally, Bulgarians use rose water/rose oil not just in cosmetic products but also as nutritional supplements and rose ingredients are ubiquitous in Bulgarian cosmetics. There are dozens of rose cosmetics brands. Most of these, however, focus on international retail and the tourist demographic and generate most of their turnover outside of Bulgaria.

Considering its comparatively small size, Bulgaria has a surprisingly large number of bona fide organic beauty brands, including Alteya Organics, Zoya Goes Pretty, Wooden Spoon, Ayan and Cocosolis. Alteya Organics, in particular, has a significant international retail footprint. Zoya goes Pretty, the own label brand of Bulgarian organic beauty/health food retailer Zoya, also has a wide online distribution in Europe.

Czech Republic: Like many Eastern European countries, herbal and plant cosmetics have a long tradition in the Czech Republic. According to Statista, the Czech natural cosmetics market is forecast to reach 33.79m USD in 2024, driven by a strong demand for regionally sourced and natural ingredients.

In 2022, the organic food market in the Czech Republic grew 12.9% compared to 2021, reaching turnover of 6.95 billion CZK (Czech koruna), according to a report by the Czech Ministry of Agriculture. Per capita expenditure on organic food reached 642 CZK in 2022. However, these results were driven by inflation rather than a genuine increase in consumption. Most organic foods were purchased in supermarket/hypermarket retail chains (34%, with turnover of 2.4 billion CZK), through e-commerce (24%, with turnover of 1.6 billion CZK), drugstores (around 18%) and in health food/organic food stores (9%).

Poland: The Polish beauty market is characterised by a particularly high percentage of domestic brands (more than 50% of beauty brands on the Polish market are local).

Over the past decade, more new brands have appeared on the market; many of which are vegan and/or have clean or natural beauty formulations. Good examples are Be Bio, the natural and vegan beauty brand launched by Polish fitness celebrity Ewa Chodakowska, or hair and skin care brand OnlyBio. According to the official Polish trade & export association/Ministry of Economic Development and Technology, the number of beauty SME grew strongly over the last five years.

Statista estimates that the Polish natural cosmetics market will reach 88.15m USD in 2024, with an anticipated CAGR increase of 8.24% by 2028. Looking at organic product retail in general, Statista figures indicate that domestic expenditure on organic consumers goods (including foods and beauty) tripled in the period from 2010 to 2022, growing from 100m Euro in 2010 to 310m in 2022.

Polish beauty heavyweights Eveline, Dr. Irina Eris and Ziaja – all brands with a strong offline distribution across Eastern Europe and several Balkan countries; according to trade.gov.pl, beauty exports grew 7% in 2020 – have long since introduced natural cosmetics ranges that are based on primarily plant-based and vegan ingredients. Eveline’s natural range is Eveline Natura, Ziaja’s contribution is Ziaja Natural Care.

Lirene is Dr. Irina Eris‘ dermocosmetics brand and launched its first Ecocert-certified beauty products – the Natura range – in 2019. The company has also been updating and relaunching its packaging over the last five years, introducing recyclable packaging (at the end of 2022, 92% of the brand’s packaging was recyclable), reducing paper consumption and a higher percentage of PCR in the plastic packaging. According to the brand, Lirene’s production facility and office runs with renewable energy.

Romania: According to Statista, the Romanian beauty & personal care market is set to grow 2.65% CAGR from 2024 to 2028, with 2024 turnover worth USD 1,897.00m. The popularity of organic food and cosmetics has been a growing since before the pandemic, albeit at a slower pace than other markets in the region.

In 2019, the Romanian government lowered the VAT on organic, traditional and health food products from 9% to 5% in an attempt to boost sales in this category.

Hungary: according to Statista, the Hungarian beauty and personal care market is projected to grow by 2.21% annually between 2024 and 2028.

Sustainable Local Beauty Brands

Bulgaria: Alteve Organics

Certified organic rose beauty brand Alteya Organics has a significant global retail footprint, both online and offline. The company has its own rose plantations and distillery infrastructure; producing rose oil, rose hydrosols and other plant waters for its own product range as well as supplying other global beauty brands with rose ingredients. First launched in 1999, Alteya Organic is still a family-owned business. The brand’s product ranges comprise face and body care, body and hair care and supplements across several sub-ranges. The latest Alteya Organics launch is the microbiome beauty range Hydrobiome.

Romania: Sabio

Organic beauty brand Sabio was founded in 2012. Named after founder Aura’s two daughters Sabina and Ioana, Sabio started out with a small range of face and body care range. Since then, the indie brand has branched out into around 400 sku's across face, bath and body care, spa products, hair care, men’s and children’s beauty and home care. All products are manufactured in small batches, ingredients are sourced in Romania as much as possible. Sabio retails its product range through its own online store, several Romanian pharmacy chains and MioBio store in Bucharest.

Czech Republic: Botanicus

Botanicus was launched in 1993 and has become one of the best-known Czech natural/herbal beauty brands. The majority of Botanicus‘ raw materials are cultivated and harvested in Ostrá, where the company is headquartered; further processing and product manufacturing take place in a facility near-by. The company also operates a craft centre and visitor facility in its Ostrá production garden which has turned into a popular tourist destination as well. Some of the Botanicus product ranges are also sold in the Czech Republic’s neighbouring countries and are available online on various European stores.

Poland: D'Alchemy

Certified organic beauty brand D’Alchemy was launched in 2017 and offers luxury-priced vegan and organic facial skincare inspired by medieval herbal formulations and aromatherapy principles. All D’Alchemy products are based on plant hydrosols and formulated with plant oils, butters and essential oils; the formulations are tested on its biovitality and packaged in violet glass to protect the formulae without having to use synthetic preservatives. Unlike many recent brand launches, the company focuses on skincare products for the 35+ demographic rather than Gen Z consumers. The pack design is stylish and minimalistic.

Hungary: Omorovicza

Luxe spa beauty brand Omoroviscza has become exceptionally successful internationally since it was first launched in 2006. The Budapest-based skincare brand has a significant distribution outside Europe, especially in the US and East Asia. Omorovisca’s products are based on biofermented thermal water from Budapest hot springs which form the base for the brand’s patented Healing Concentrate complex. The product ranges focuses on face care but also offers some bath and body care products as well as sun care. In June 2023, the brand opened its first international destination store in London’s Mayfair area.

Marketing & Retail Insights

Bulgaria: Zoya is the largest organic beauty and food retail chain in Bulgaria. Founded in 2009 with most of its offline stores located in the capital city of Sofia, the six Zoya stores sell a wide range of domestic and international organic beauty brands and foods/health foods, both offline and through the company’s flourishing e-commerce business – according to Zoya, the company shipped over 50,000 orders in the first half of 2023 alone. Since the beginning, Zoya has been involved in community and charity causes, donating goods and collaborating with Bulgarian non-profits on specific projects.

Several of Zoya’s Sofia stores include a café and/or smoothie bar and every outlet also offers specific foods (mostly dry goods like nuts, pulses, cereals, rice, noodles etc.) in bulk. Consumers who bring their own reusable containers to buy bulk grocery products get a 10% discount on their purchase. The Zoya outlets also retail beauty ingredients (plant oils, plant butters, essential oils, emulsifiants, herbs, hydrosols) and empty beauty containers in bulk, making the brand the largest manufacturer of DIY beauty items.

Romania: There are dozens of organic and health food stores and supermarkets in the capital city of Bucharest. However, the majority of shops are independently owned with very few retail chains in evidence. Other important distribution channels for natural and health foods are farm shops, farmer’s/peasant’s markets and online retailers.

A similar situation applies to organic beauty retail, most stores in this category are independently-owned smaller shops. MioBio was one of the earliest organic beauty retailers in Bucharest; the store first opened its doors in 2009 and sells a wide range of European and domestic cosmetic brands.

After Romania joined the EU in 2007, a slew of local artisan, small-batch indie brands appeared on the market including Transilvanian brands By Codru and Prisaca Transilvania, and Bucharest-based Raftul cu Miresme, NN Natural Nutrition, Cremeria and Sabio. Most of these small-batch brands don‘t have a particularly large distribution outside of their home market and primarily retail online.

German drugstore retailer dm Drogeriemarkt also plays a significant role in the country’s beauty retail (both in conventional cosmetics and natural beauty). The German chain opened its first dm store in Romania in 2007 and at the time of writing, there are 139 dm outlets across the country, primarily located in the urban/metropolitan areas.

Poland: While there are many health food and organic food stores in Poland’s capital Warsaw and throughout the rest of the country, the majority are small, independently-owned businesses and there are very few retail chains.

A new generation of domestic organic, vegan and niche/indie beauty retailers offer a wide range of Polish and international natural beauty. Polish Nature Beauty Bar in Warsaw, for example, sells stylish domestic brands such as Mokosh Cosmetics, Iossi and The Sky Girl while SlowGlow in Krakow sells a wide range of mostly domestic beauty, household and fashion/accessories brands, including D’Alchemy, Bottica and Hagi.

In the mass market, German drugstore chain Rossmann is the leading drugstore retailer in Poland, the company opened its first Polish store in 1993. Today, Rossmann operates 1,780 drugstores across the country. Amongst the domestic beauty retailers, Polish drugstore chain Natura is one of the largest players.

Czech Republic: Botanicus was first launched in the early 1990s, growing from a small farm and herb garden to become one of the best-known Czech herbal beauty brands. Today, Botanicus operates four flagship stores in the Czech Republic’s largest cities and a flourishing online store. The Botanicus store in Prague’s Ungelt neighbourhood is one of the most popular tourist stores in the Czech’s capital; the shop is listed in all national and international city guides and is considered to be one of the city‘s official tourist attractions by Prague Tourism.

Manufaktura has a similar brand history. Launched in the early 1990s after the fall of the Iron Curtain, the company manufactures beauty products and handicrafts proudly made in Czechia. The Manufaktura cosmetics range focuses on plant-based, herbal beauty formulated according to traditional Eastern European herbal/medicinal recipes. Today, Manufaktura operates around 45 stores in the Czech Republic as well as running five stores in the neighbouring country of Slovakia.

Biooo.cz is an organic beauty and food e-commerce retailer that also operates six highly successful offline stores in the Czech Republic. Launched in 2008, Biooo sells a very wide range of European and domestic organic beauty brands as well as a comprehensive selection of organic foods and beverages.

- The influence of German chains in organic beauty retail in Eastern/South Eastern Europe: The German drugstore chains, especially the dm and Rossmann chains, play a significant role in organic beauty retail in all four countries.

Dm and Rossmann both offer highly successful and very large certified organic own label beauty brands (dm: Alverde, Rossmann: Alterra) and natural/health foods brands (dm: dm, Rossmann: enerBio) which form a key part of the retailers‘ brand portfolio in its international markets.

The German Rossmann chain opened its first Polish drugstore in 1993, today there are 1780 stores across Poland, making Rossmann the de factor drugstore market leader in the country. In the Czech Republic (1994), Rossmann operates 160 stores. Dm’s operations in Poland started in 2022, there are currently 18 dm stores across the country. In the Czech Republic (1993), the retailer operates 255 outlets, in Romania (2007) there are 139 dm stores and Bulgaria (2009) dm has 109 dm stores.

- The influence of European supermarket/hypermarket chains in Eastern/South Eastern Europe: Another key distribution channel for health foods and organic beauty – as well as food and cosmetics in general – are the big European hypermarket and supermarket chains. The French and German retail giants are particularly strongly represented in most Eastern European markets.

In Romania, the biggest supermarket chains are Carrefour (F), Auchan (F), Kaufland (D) and Lidl (D). The top 10 supermarket chains in the country also include Profi and MegaImage (Ahold/Delhaize, NL), Rewe and Metro (D). Poland’s top supermarket/hypermarket chains include Jeronimo Martens (Portugal), Lidl/Kaufland (D), Żabka (PL), Auchan and Carrefour (F).

In the Czech Republic, the major supermarket chains include Lidl, Kaufland, Globus and Rewe (D), Ahold Delhaize (NL) and Tesco (UK) and in Bulgaria, major players include Kaufland, Lidl and Billa/Rewe (D), T Market (Lithuania), Fantastico, Hit and Dar (Bulgaria).

Action Points

- In total, Eastern Europe registered one of the highest inflation rates worldwide in recent years, reaching 14% in 2022, according to Euromonitor. As a result, the purchasing power of the local consumers was severely impacted and like in other Western and Eastern European countries, customers turned to lower priced brands.

- Therefore affordable sustainability is key in connecting with Eastern European consumers. The rising cost of living, soaring prices for consumers goods – especially for groceries/foods – and uncertainty about the future is causing Eastern European consumers to look for more cost-effective options whilst reducing consumption.

- In countries like Romania and Bulgaria where the governments are avoiding their EU-mandated environmental responsibilities, domestic grassroots activists and international supermarket retailers are stepping in to help create a more sustainable infrastructure and make living a sustainable lifestyle easier and more affordable.

- As the big European supermarket giants like Carrefour, Auchan, Kaufland and Lidls tend to dominate big box retail in all four countries, sustainability initiatives from these retailers tend to have the biggest impact. As an example, in December 2023, Carrefour Romania launched a pilot project with InspirAction in which 1,200 students and teachers from six educational institutes got involved into recycling PET bottles and aluminium cans. As a result, all participating schools were equipped with solar panels.