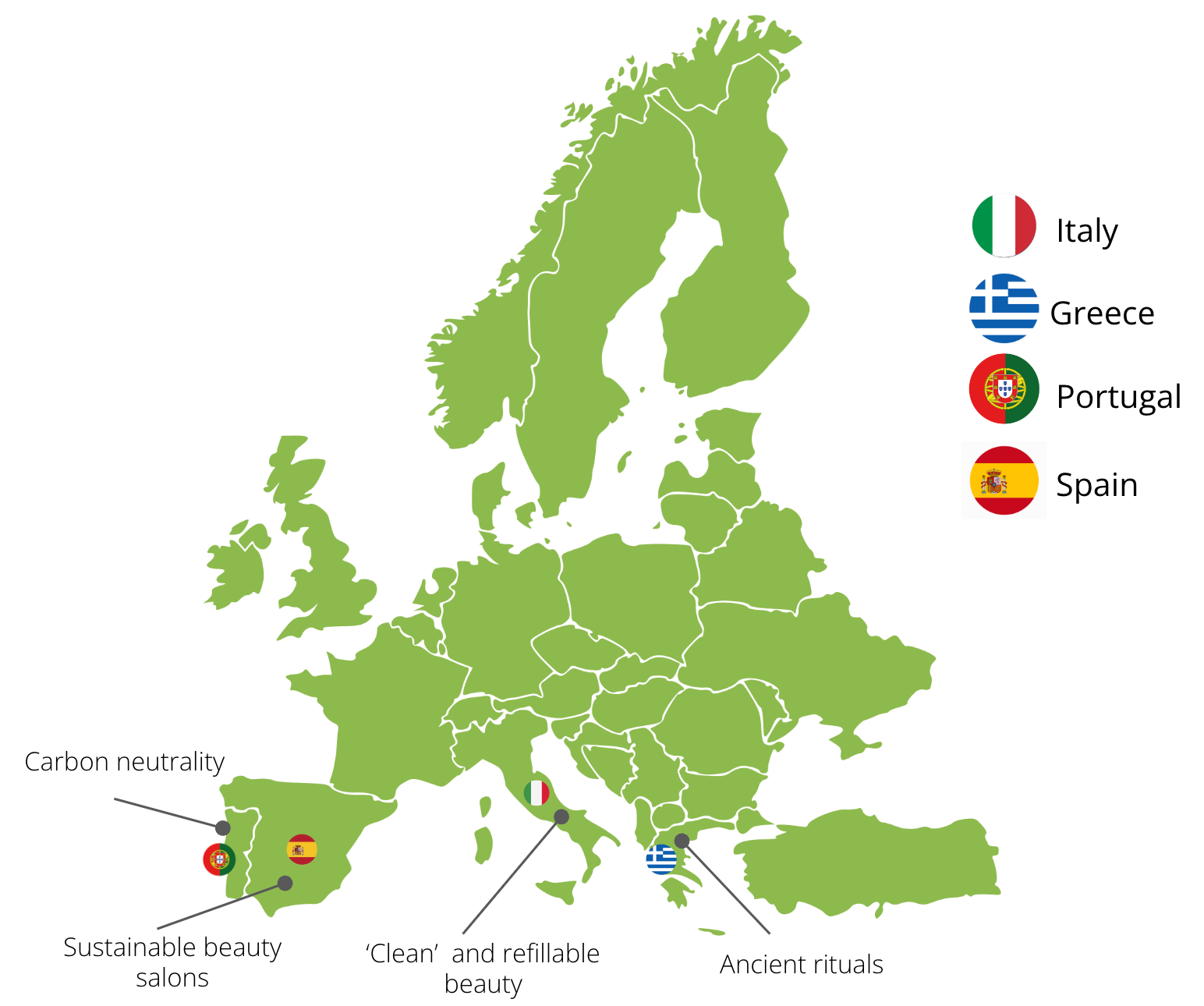

Consumer & Sustainability Perceptions 2024: Southern Europe

Our Consumer & Sustainability Perceptions 2024 report is part of a series of reports that explores how consumers view beauty and sustainability around the globe.

This report spotlights four countries in Southern Europe (Italy, Spain, Portugal and Greece). It includes consumer data and insights as well as highlights local beauty brands that are innovating in the beauty sustainability space.

Our Consumer & Sustainability Perceptions 2024 report is released in eight parts covering different regions around the world:

- Latin America - HERE

- Asia-Pacific - HERE + Malaysia - HERE

- UK & Northern Europe - HERE

- Southern Europe (below article) HERE

- Western Europe - coming soon

- Central & Eastern Europe - coming soon

- North America - coming soon

- Middle East & Africa - coming soon

Sustainable Initiatives & Priorities: Snapshot

Regions: Southern Europe

Four key markets will be covered in this report:

Italy

Market Insights

Economy

- 71% of consumers consider cost of living a big problem, and 63% of them are worried about the economy.

- Nonetheless, in 2023, the cosmetics sector in the country experienced a 8.8% growth.

Because of the current economic crisis, 58% of Italians tend to buy more affordable beauty products than in the past

Climate & Environment

- Climate change is at the top of the list of Italians’ concerns, together with the rising cost of living.

- Italy is one of the highest-performing countries in Europe in terms of urban waste recycling, with a percentage reaching 72% – significantly higher than Europe’s average of 58%.

Beauty

- Italian consumers expect cosmetics to become more sustainable in the future.

Safe beauty, skinimalism, and circular beauty are amongst the main beauty trends in the country

- Consumers are drawn to beauty products that are more versatile and minimise waste whilst still offering great performance.

- Diversity and inclusion are two other hot topics in the industry, which Italian cosmetics experts deem crucial to allow the sector to achieve its planned $75 billion value in 2025.

- Social media “skinfluencers” are gaining more and more popularity in the country.

- Pharma-beauty represents a strong channel in the country for the sale of beauty and cosmetics products.

- A growing number of male consumers is buying more cosmetics products.

Consumer Sustainability Perceptions

- By the end of 2023, the “green” segment of the Italian cosmetics industry was worth in excess of EUR 3.1 billion, and represented 25% of the total cosmetics market in the country.

- Refillable beauty is on the rise in Italy. Several masstige brands, including the popular Diego Dalla Palma, are offering refillable options for some of their best-selling products. However, this option is still not as widespread as many Italians – 78% according to one survey – would like.

- Holistic wellness is gaining traction in the country, further pushing consumers’ drive towards more ethical and natural formulations.

Italians opt for cleaner products because they are better for the body (48%), help reduce environmental impact (47%), and are not tested on animals (45%)

- Brand storytelling is an essential tool to help consumers embrace more sustainable beauty practices, as well as strengthen beauty brands’ roles in showcasing their commitment to sustainability.

- Young beauty consumers are influencing older generations in their quest for greener, more sustainable, and more natural beauty products

- Millennials and Gen Z are the two categories who invest more in makeup products.

- 33% of Italian consumers like to follow beauty influencers who post makeup tutorials and similar types of content.

Cosmetics brands launching “eco” or “green” products on the Italian market have grown from 56.6% in 2019 to 63.9% in 2024

- Claims of “sustainability” as opposed to “naturality” of a beauty products have grown massively, with 72.4% of beauty brands using the former on their packaging/marketing, and only 27.6% opting for the latter.

Sustainable Local Beauty Brands

Davines

Founded in 1983 in Parma, Italy, haircare brand Davines is synonymous with sustainability and innovation, always at the forefront of creating more ethical, responsible, and high-performing products.

La Saponaria

Popular beauty brand La Saponaria focuses on soap bars and personal care products formulated using natural ingredients in what the brand describes as a “conscious, zero-impact micro-laboratory”.

Equazione

Developed by pharmacist Giusi Aricò, Equazione is a skincare and fragrance brand strongly rooted in its Sicilian heritage. Its essences feature botanical ingredients, and its packaging includes glass as well as 100% recycled and recyclable PET.

In Aéras

With a strong focus on traditional Sardinian knowledge and medicine, In Aéras features plant-based products crafted locally and in small batches, and packaged using cases made with 100% with FSC®Recycled certified post-consumer recycled paper.

Marketing & Retail Insights

- La Saponaria created “La Saponaria x Pesaro 2024”, a limited-edition range of sustainable cosmetic products to celebrate the fact that Pesaro, the Italian city where the brand is from, was nominated the country’s culture capital of 2024. This is a capsule collection that aims to convey the key message of Pesaro 2024: “The nature of culture”.

- To celebrate World Earth Day, Davines launched “Grow Beautiful”, a socio-environmental campaign promoting organic regenerative agriculture as a way to fight climate change. This year, the hero product of this campaign is WE STAND/For Regeneration Hair & Body Wash Bar – a solid shampoo + shower gel in limited edition, featuring a 99.7% biodegradable formulation and 100% recyclable paper packaging.

- Several beauty stores – including Armani, SEPHORA, Douglas, and Pinalli – offer consumers the possibility to purchase in-store refills of their favourite beauty products.

- Giorgio Armani launched an innovative version of its iconic fragrance Acqua di Giò. This features refillable packaging which, in its 50ml version, allows consumers to save 42% glass, 16% plastic, 75% metal, and 37% paper compared to the non-refillable option.

- Popular Italian retailer Acqua & Sapone – which focuses on personal and home care products – is now taking part in the Treedom initiative. Through this, the company has contributed to planting over 15,000 trees across the world – including in Italy, Cameroon, Colombia, and Madagascar.

- Italian influencer Camilla Mendini, better known as Carotilla, regularly shares her tips on how to live a more sustainable lifestyle both on her Instagram page and on mainstream media, such as national newspapers. In 2023, she also launched her own line of sustainable beauty products – Cor Beauty Bar.

Greece

Market Insights

Economy

56% of consumers in Greece are very concerned about the increased cost of living

- Nonetheless, according to official data, the Greek economy is experiencing a rebound, with a forecasted 3% growth in 2024.

Climate & Environment

- Despite many citizens being concerned about climate change, a large proportion of young people doesn’t associate it with extreme weather events.

- Greece dropped four places in this year’s CCPI (Climate Change Performance Index) – from 24th to 28th.

- Greece’s revised National Energy and Climate Plan (NECP) draft includes increasing the country’s reduction target for greenhouse gas emissions by tapping into renewable energy.

Beauty

- In 2023, consumers purchasing habits have changed across all sectors, including beauty and skincare, due to the country’s high inflation rates.

- Interestingly, though, despite inflation and rising concerns around cost of living issues, the trend of premiumisation has made its way into the Greek beauty sector. The biggest sub-category to show this trend was dermocosmetics.

Greek consumers are more and more interested in purchasing products with solid, fact-checked scientific claims

- Overall, consumers in Greece are demanding natural, organic, and sustainable beauty products.

Consumer Sustainability Perceptions

- Greek consumers are increasingly buying personal care, beauty, and personal hygiene products in supermarkets.

- 56% of Greek consumers also purchase cosmetics in pharmacies, with 32% of them stating they often make “unplanned purchases” of cosmetics products when they are in these settings.

According to Statista, the Natural Cosmetics Market in Greece is expected to reach US$6.41m in 2024, with revenue projected to show an annual growth rate of nearly 7%

- By 2029, the number of consumers interested in this market segment is expected to reach almost 200,000, with almost 2% user penetration.

- User penetration will be 1.7% in 2024 and is expected to hit 1.9% by 2029.

- The average revenue per user (ARPU) is projected to reach US$44.71.

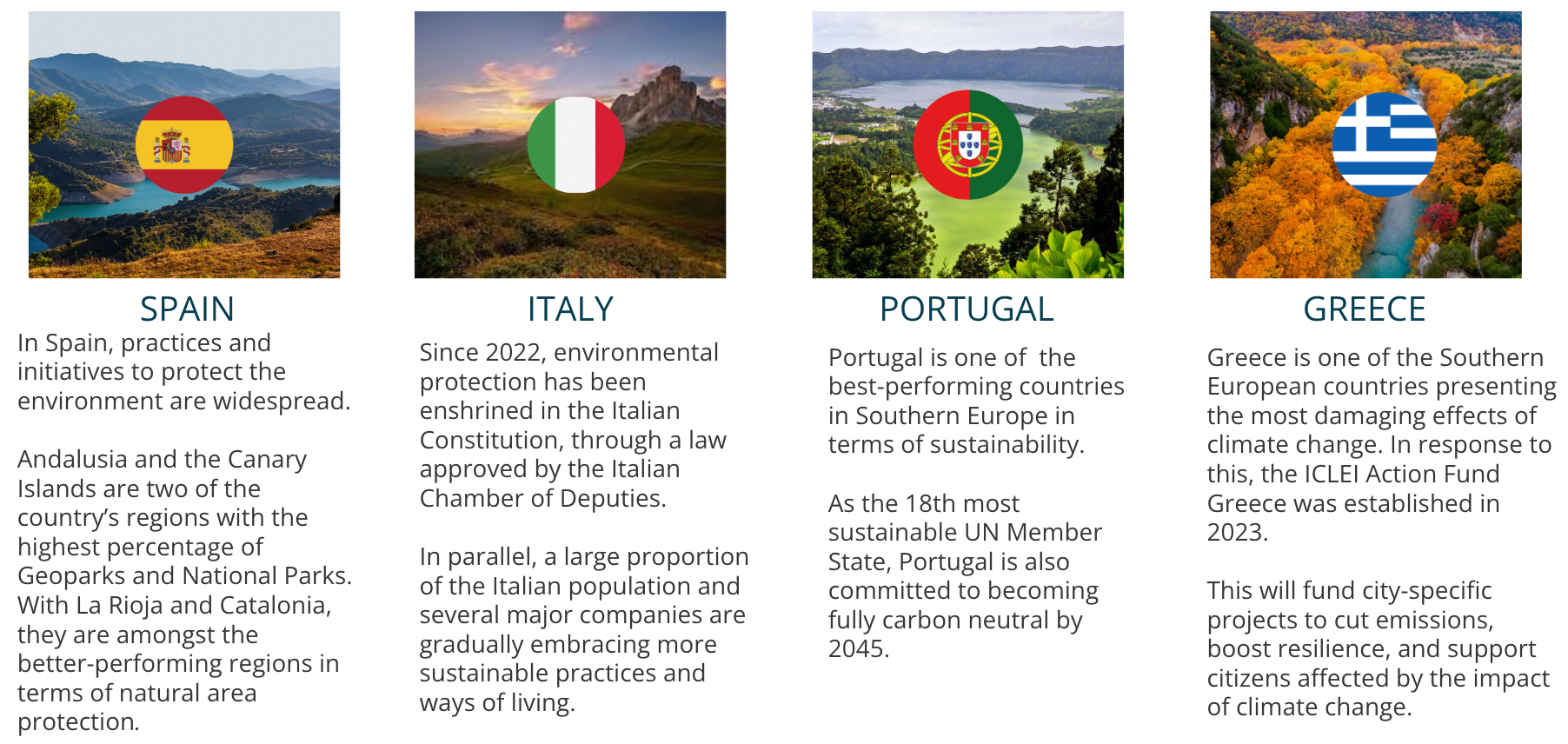

Sustainable Local Beauty Brands

Korres

With its in-store recycle lab and unflinching commitment to sustainability, Korres has established itself as a stalwart in the sustainable beauty industry.

Kear

Award-winning “clean” skincare brand Kear promotes ancient Greek beauty rituals through its range of products that are entirely sourced and made in Greece from local producers.

Onar

Deeply rooted in ancient Greek beauty practices, luxury SPA brand Onar features a range of products that combine cosmetics technology with natural ingredients.

Clinéa

With its refillable jars, naturally-derived products, and efficacious formulations, Greek brand Clinéa is rapidly establishing itself as a leader in sustainability and ethical beauty practices.

Marketing & Retail Insights

- Popular skincare and haircare brand Korres does more than promoting – and following – sustainable practices in the formulation, packaging, and distribution of its products. It actively supports the Greek community by buying 100% of its plant materials from Greek farmers, while also extracting actives in its state-of-the-art lab.

- Several beauty and skincare brands in Greece are offering refillable options to customers, both in-store and online.

- Greece has a range of online stores exclusively specialised in “clean” beauty and skincare products. Some of these include Panabeau, Care to Beauty, and Greek Bio Cosmetics.

- Brands like Onar, Kear, and Bliss of Greece aim at fostering a connection between today’s science, knowledge, and technology around cosmetics and beauty and skincare rituals from Ancient Greece.

- Upcycled ingredients are increasingly more used by Greek beauty brands. Apivita, for example, uses upcycled vine leaves and propolis in some of its products.

Portugal

Market Insights

![boats docked near seaside promenade]](https://images.unsplash.com/photo-1555881400-74d7acaacd8b?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDJ8fHBvcnR1Z2FsfGVufDB8fHx8MTcxNTUzNDUyNHww&ixlib=rb-4.0.3&q=80&w=2000)

Economy

- 48% of people in Portugal believe the economy worsened in 2024.

- Estimates from the EU, however, forecast a steady growth as well as a decrease of inflation rates in both 2024 and 2025. 2% growth of the country’s economy in 2024.

Climate & Environment

- 82% of Portuguese people believe the challenges of climate change should be addressed together with those around social injustices and inequalities.

- “Sustainable living” is a growing trend in Portugal, and it encompasses different areas of a person’s life.

Portugal currently ranks 18th most sustainable UN member state according to the Sustainable Development Report of 2023

- In the country, more than half of the electricity is sourced from renewable sources, such as solar and wind.

- The country has set an ambitious goal to achieve net-zero emissions by 2045, which would be 5 years ahead of schedule.

Portuguese people have embraced eco-friendly practices and ways of living in a shared, communal way that connects larger cities to smaller, rural villages

- The Eco Village in Serra da Estrela is a prime example of how much Portuguese people care for the environment by embracing more ethical and sustainable lifestyles in a collective way.

Beauty

- In the country, there is a strong focus on science and knowledge in beauty.

- Demand for organic and natural products in skincare is on a constant rise, which goes hand in hand with the country’s commitment to becoming more environmentally conscious.

- The “less is more” approach to beauty and skincare is gaining a lot of popularity in the country. This is due to a desire to waste less as well as create more minimalist and personalised routines that truly benefit every person’s individual needs.

- In parallel, cosmetics brands are also increasingly opting for less wasteful, more sustainable packaging options, as well as with the sustainability of the entire supply chain.

Consumer Sustainability Perceptions

- Portuguese consumers keep prioritising the purchase of items such as medicines, essential clothing, and food. The sales of Items such as beauty products and cosmetics have experienced a slight reduction in recent years.

- Nonetheless, 80% of Portuguese consumers prefer to buy eco-friendly products, even if prices tend to be higher. This seems to match the current trend in the country for natural and organic products.

More than half of Portuguese consumers state they buy eco-friendly products every month

- More than 70% of consumers would be happy to start using refills for shampoos, shower and bath products, and other types of cosmetics, in order to reduce plastic consumption and waste.

- 29.7% of Portuguese people regularly purchase beauty products online, with almost half of all beauty consumers in Portugal being women over 55 years old.

- Social networks are the main way in which consumers discover and explore the world of “green” beauty brands. Particularly, users are drawn to user-generated content (for the so-called e-WOM effect), influencer marketing, and brand content.

Sustainable Local Beauty Brands

8950 Cosmética

By combining science, ecology, and sleek aesthetics, skincare brand 8950 Cosmética – named after the postal code of its hometown – offers plant-based, high-performing, luxurious products for face, hair, and body.

Benamôr

One of the oldest and most established cosmetics brands in Portugal, Benamôr is also committed to sustainability through packaging coming from highly recyclable sources (aluminium, glass, and cardboard), natural-origin ingredients, and in-store refillable schemes.

Catarina Barbosa

Catarina Barbosa is an award-winning skincare brand that celebrates “clean, vegan, and conscious beauty”. The brand offers a range of luxury skincare products whilst also embracing sustainable practices across its entire supply chain.

Ignae

Born in the Azores, Portugal’s unspoilt archipelago, Ignae embraces the 12 principles of green chemistry and leverages biotechnology to minimise its impact on the local natural habitat. The brand sources only Azorean ingredients and follows “wild harvesting” practices in compliance with strict SFC (Sustainable Farm Certified) guidelines.

Marketing & Retail Insights

- Popular eco-friendly online cosmetics store Inouïe Beauty – the brainchild of two friends who met whilst studying pharmacy – regularly posts social media content to educate consumers about “green” beauty brands, as well as content that advises on how to create a more sustainable beauty routine.

- Similarly to Inouïe Beauty, The Green Beauty Concept does what it says on the tin: it’s an online store that only sells natural and sustainable beauty products. Aside from its full-priced items, the store frequently offers deals through its Zero Waste Outlet. The website also features a range of guides, including one called Vegan Makeup Essentials. On its Instagram page, The Green Beauty Concept regularly posts educational content about active ingredients and sustainable skincare brands.

- Organic food store Celeiro has massively expanded its beauty aisle in the past two years. Today, it stocks brands such as Dr. Organic, Logona, and Neobio.

- Portuguese skincare brand Benamôr has started offering its customers the possibility to buy refill directly in-store, thanks to the installation of refill stations in several of its locations.

Mirroring a wider trend in other Southern European countries, Portugal is also starting to see an increase in so-called “sustainable beauty salons”

- More and more brands in the hair care sector are standing out as pioneers of sustainability in a segment that has traditionally not always been the easiest to transition to these practices.

- In particular, Andreia Professional has introduced – wherever possible – 100% recycled packaging, as well as being active in carbon emission compensation programmes through the Amazon Forest project, in partnership with Carbon Fund. Through this, the brand has already eliminated nearly 300 tons of CO2. Furthermore, the brand’s partnership with ANEFA has enabled it to plant more than 500 trees across the country.

- L’Oréal Portugal has renewed its Academia do Porto – an eco-friendly setting with a commitment to supporting beauty professionals through high-quality education and a focus on the importance of themes such as sustainability and technology in the industry.

Spain

Market Insights

Economy

- Employment rates and the country’s overall economy are following a positive trajectory in 2024.

- However, a recent survey found that 43.1% of Spanish citizens deems the economy “bad”, with a further 13.8% considering it “very bad.”

Climate & Environment

- A survey conducted by Real Instituto Elcano found that 16% of the people interviewed considered climate change a threat facing the world – placing it in second position after armed conflicts (38% of surveyed).

Over 70% of people think that the government is not doing enough to fight climate change

Beauty

- An increasing number of beauty consumers is embracing a DIY approach to beauty, creating their own products and routines.

- Alongside environmental concerns, Spanish beauty consumers are very much focused on product efficacy. For this reason, they are increasingly interested in using products that feature well-known, effective ingredients, such as hyaluronic acid and AHAs.

- The so-called “clean beauty” trend in Spain was hugely accelerated by the COVID-19 pandemic, which led people to search for “safer” ingredients and products.

- A study conducted by McKinsey Spain revealed that the “premiumisation” of beauty products is going to be one of the biggest trends in the country.

Consumers are not only asking for natural and organic beauty products, but are also concerned about their traceability and environmental impact

- Versatile, multi-functional ingredients are becoming increasingly important for Spanish beauty consumers.

- Beauty minimalism is a strong trend in the country, with people looking to simplify their skincare routines in order to spend less and produce less waste.

Consumer Sustainability Perceptions

74% of Spanish consumers have sustainability as a priority while deciding on a purchase

- Nonetheless, Spanish consumers are 10% less concerned with sustainability compared to their German, French, and British counterparts.

- Interestingly, though, 59% of Spanish consumers believe that natural and sustainable products are not necessarily more effective or better performing compared to non-natural ones.

- 80% of Spanish beauty consumers believe that brands should be more transparent with regards to sustainability. 71% of them read a product’s packaging in detail, while 60% looks for any sustainability “proof”, such as a sustainability certification.

Only 36% of consumers believe they can tell when a cosmetic product is “natural” or not

- 60% of Spanish female consumers state that they prefer to “feel good” as opposed to simply “look good”.

- 2 out of 5 Spanish female consumers say they spend more on skincare and personal care products instead of makeup.

23% of Spanish female consumers have simplified their skincare routine, due to concerns about money, waste, and the environment

- 19% of consumers have transferred their “clean eating” practices to their beauty and skincare routines.

- When it comes to defining a “sustainable” skincare product, 6 out of 10 consumers believe that it’s a product containing “some natural ingredients”. 2 out of 10 consumers think it’s a product without chemicals or additives, but are not sure which ingredients, exactly, should be removed from the formulations. For 1 in 20, a sustainable product means a product that is vegan and has not been tested on animals. However, they are unaware that, according to EU law, all cosmetics products on the market must already be cruelty-free.

Sustainable Local Beauty Brands

NaturaBissé

Famed for its high-performing, luxury skincare products, Barcelona-based NaturaBissé is also strong on sustainability. Its offices, in fact, are powered mostly through renewable energy sources.

Valquer

Valquer is one of the country’s pioneers in solid shampoos. The brand offers formulations that feature 0% soap, are plant-based, and are produced with responsible and ethical methods.

The Organic Republic

Based in Barcelona, hair care brand The Organic Republic puts the emphasis on creating natural products that restore hair density and scalp health whilst also promoting self-care and self-confidence.

Foosh

With its biodegradable packaging and upcycling processes (mostly, using discarded grape waste), young and ambitious Foosh has circularity at its core.

Marketing & Retail Insights

- L'Oréal Spain has joined the brand in other countries on the innovative initiative dubbed “Hairstylist for the future”. Over 500 hair salons across Spain are now embracing more sustainable, waste-conscious practices that will enable them to save up to 69% of water for each hair wash, create partnerships with local renewable energy providers, and recycle most of its leftover hair clippings, which will be reused in the regenerative agriculture sector.

- Sustainable beauty salons are becoming a thing, in Spain. In Barcelona, Madrid, and Valencia, beauty therapists opened salons that not only provide services and treatments using more natural and sustainable ingredients, but that are also very eco-conscious in their business practices.

- Biodrops has launched I Disappear by Biodrops, a personal care solution for hotels that is 100% biodegradable and plastic-free. This innovation won the brand a circularity award at the 2024 edition of Premios ANOVO.

- To mark World Tree Day, Spanish skincare brand Maminat has joined the Plant for Life programme, contributing to planting over 120 million new trees around the world, whilst also supporting forest regeneration projects.

- Tarragona-based Freshly Cosmetics leverages its huge and loyal social media following mostly through influencer and celebrity marketing to promote its natural products, embrace a more sustainable lifestyle, and even get to know the brand “behind the scenes” by showing its labs and production processes.

- Spanish sun care brand ISDIN regularly carries out campaigns centred around the importance of sun protection to help combat skin cancer. It does so by engaging with institutions such as schools as well as during sports events such as tennis tournaments.

Action Points

- Brands need to strengthen their commitment to sustainability: Southern Europe is growing increasingly concerned about the environment and the climate crisis. These factors are leading large swathes of the population of these countries to opt for eco-friendly products, as well as recycle their waste regularly.

- When it comes to the beauty industry, brands in these countries are gradually embracing global sustainability trends, including waterless/solid formulations, refillable schemes, and ethically-sourced ingredients.

- Pricing remains a concern: many people across this region are bearing the brunt of the economic recession and the increased cost of living, which is leading them to search for lower-cost alternatives in all areas – including beauty.

- Consumers are confused: more clarity on what “natural” and “sustainable” mean when it comes to a beauty product is needed from brands.

- Skinimalism remains a strong trend: whether to cut waste, save more money, or simplify beauty routines, many consumers in this region are embracing more minimalistic choices when it comes to skincare.

- Transparency is a must: consumers are increasingly demanding more clarity, transparency, and education from beauty brands in terms of their sustainability choices and practices across the entire supply chain.

- The power of social media: across the whole region, consumers leverage social media channels to learn about sustainable brands, educate themselves on natural ingredients and ethical practices, and discover new products to try.