Nearly a quarter of the population continues to maintain their eco habits - reveals Worldpanel

In its latest "Who Cares? Who Does? Sustainability 2025" report, now in its 7th year, Kantar Worldpanel examines the gap between consumer concern for sustainability and their actual actions.

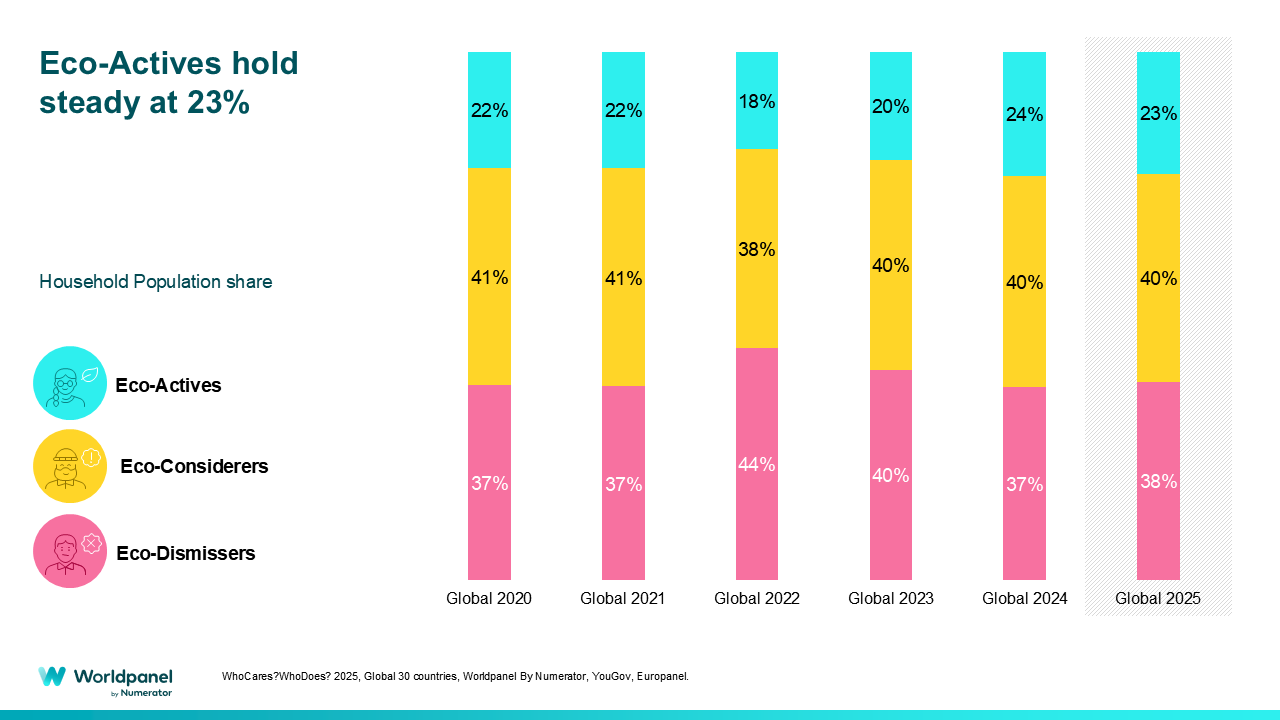

The report uses an eco-segmentation model, dividing consumers into three groups based on their engagement with environmental issues, particularly plastic waste:

- Eco-Actives: Highly concerned about the environment, they make significant efforts to reduce waste and feel an intrinsic responsibility to be sustainable. They actively follow environmental topics.

- Eco-Considerers: Worried about the environment and plastic waste (similar to Eco-Actives), but their actions are closer to Eco-Dismissers. Their primary barriers to action are convenience and price.

- Eco-Dismissers: Have little to no interest in the environment, make no efforts to reduce waste, and lack awareness of environmental concerns. Their motivations for taking sustainable actions are usually health- or cost-related, rather than ecological.

The report tracks the global proportion of these segments, showing that in 2025, Eco-Actives hold steady at 23% (a slight 1% drop from previous years), Eco-Considerers are static at 40%, and Eco-Dismissers have risen to 38%.

Factors influencing these segments include economic prosperity, environmental disasters, and government-led education. Higher GDP generally correlates with more Eco-Actives due to better education, less financial pressure, and broader access to sustainable alternatives. Significant events like floods and wildfires can also trigger increases in engaged consumers.

Despite political headwinds and attacks on climate policies, nearly a quarter of the population remains Eco-Active, maintaining their eco-friendly habits. This Eco-Active group represents a significant global FMCG value of $613 billion, making it a valuable target for brands. The report also highlights the importance of brands in driving sustainable choices and suggests actions brands can take to redefine their positioning.

Finding the right trade-offs

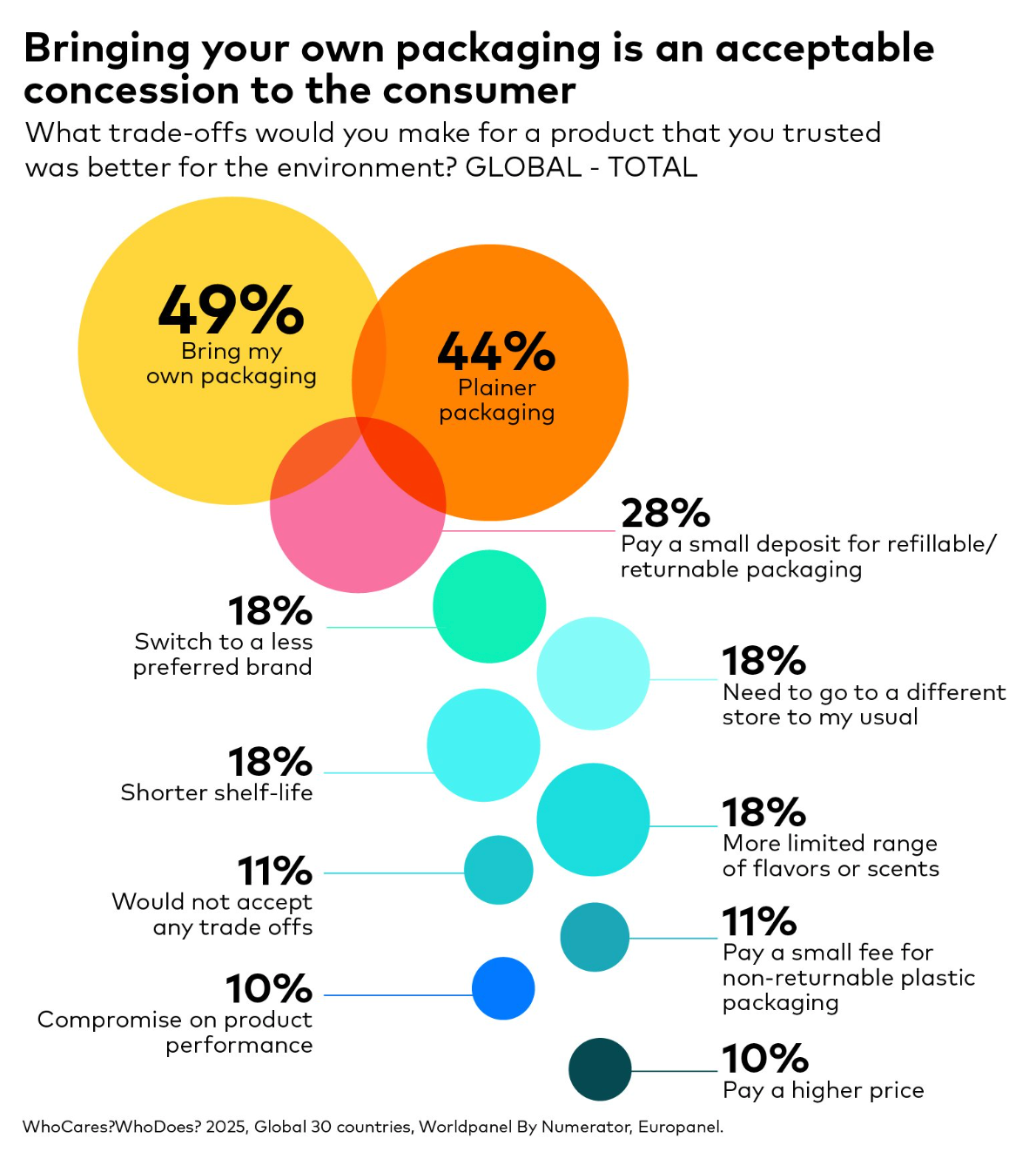

The report reveals that consumers want to do better for the planet, but only if it feels easy, affordable, and rewarding.

Despite good intentions, trust in brands remains fragile:

- six in ten people still believe companies use sustainability as a marketing ploy, and just one in five truly feel their personal choices can make a difference.

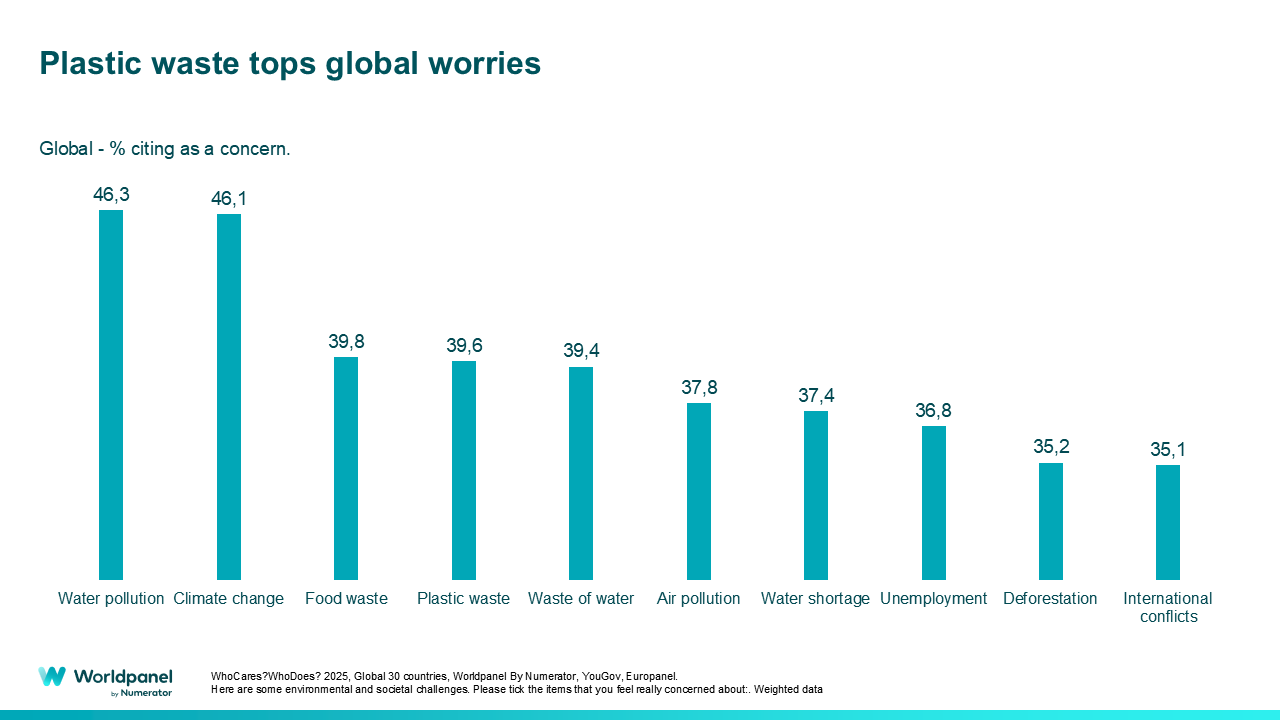

When change works, it’s typically a combination of effective incentives and convenience. Government-imposed fees on plastic bags, for instance, have made reusable totes a mainstream option, as plastic waste remains a global concern.

Similarly, brands like Stanley and its famous cup have turned refillable bottles into cultural icons, demonstrating that sustainability can be a compelling selling point when it aligns with identity and practicality.

Anchoring and identity are key to avoiding greenwashing, as our marketing report on brand purpose suggests.

Most people are open to some compromise for greener choices, but not when it comes to price. Only 10% would be willing to pay more for sustainability. The sweet spot lies in “win-win” solutions that save money and reduce impact, such as bringing your own packaging (already adopted by half of global consumers) or deposit-return schemes that reward recycling.

Even simple habits like drinking tap water come down to the same equation: convenience and cost first, with excess packaging a strong secondary motivator.

In short, the path to sustainable behaviour runs through small, tangible benefits and less guilt, more ease, and maybe even better design/innovation.