Natural ingredients boosting UK beauty and personal care sales

Despite continued increases in the price of goods and services, consumers proved willing to maintain spending habits on beauty and personal care products, according to data analytics company Euromonitor International.

Europe had the third largest beauty....

- ... and personal care sales market globally, reaching US$138 billion sales in 2023

- Skin care is the clear leader among the categories in Europe, accounting for almost a quarter of overall retail value sales

- UK is the second largest beauty and personal care market behind Germany in Western Europe, reaching US$18.7 billion sales in 2023, growth of 7.4% on the previous year

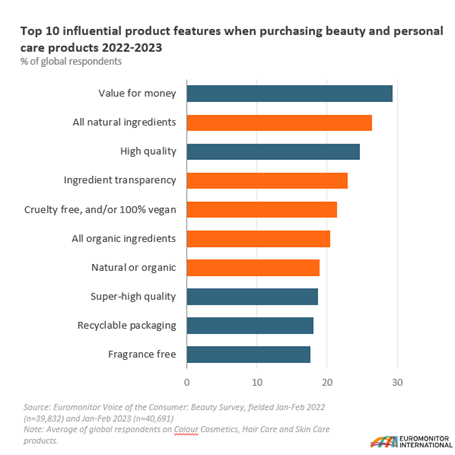

The increasing demand for natural ingredients and multifunctional products, reflects a shift towards more sustainable and health-conscious choices.

Consumers are adopting new financial or lifestyle tricks to make the most of their income. According to Euromonitor International’s Voice of the Consumer: Lifestyles Survey for 2023, 44% of global consumers planned to save more money in 2024.

In the beauty space, consumers are becoming ‘skintellectuals’

Euromonitor has identified ingredient-led beauty as one of the top five trends to influence beauty and personal care in 2023. Beauty consumers are continuously searching for newness and innovation, spending more time researching products online and becoming ‘skintellectuals’.

Although Gen Z and Millennials are driving this trend, beauty consumers of all ages are craving authenticity and thus storytelling is gravitating towards traditional ingredients well known in beauty cultures.

“Ingredient-led beauty focuses on the benefits of specific ingredients and enables consumers to understand and find actives that will treat or prevent their specific skin concerns, leading to a more personalised and targeted skin care routine," explained Emilie Hood, Consultant for Beauty and Personal Care at Euromonitor International.

“The rising priority of health and wellness has led consumers to dig into ingredients coming from traditional Chinese medicine and Ayurveda as consumers crave authenticity and efficacy,” added Hood.

According to Euromonitor International’s Voice of the consumer: Beauty Survey for 2023, in Europe 23% of skin care consumers looked for natural or organic ingredients in products.

Blurring of category definitions and increasing demand for multifunctional products

The blurring of category definitions and increasing demand for multifunctional products is especially seen in skin care, sun protection and colour cosmetics. As cost-effective, time-saving options, products offering multi-benefits are gaining traction as consumers prioritise skin health and ease of use, as they revert to busy pre-COVID routines.

Heightened demand for clinically-positioned beauty presents an opportunity within the multi-functional space with products like sun care and deodorants, seeing ‘skinified’ - the adoption of skin care traits in non-skincare products - formulas providing more than traditional claims.

Dermocosmetics outperformed the industry growing 13% globally in 2023, and are at an all-time value high due to the association with efficacy and focus on both prevention and solutions.

“Consumers are embracing healthier lifestyles with greater focus on self-care and prevention. The active pursuit of holistic wellness extends beyond physical health to incorporate mental and emotional wellbeing,” Hood added.

For more insights on beauty and personal care, see Euromonitor International’s report World Market for Beauty and Personal Care 2024.

Global Beauty Market Figures

- Beauty and personal care sales reached USD570.1 billion globally in 2023, growing 3% in 2023 in constant terms. Skin care and colour cosmetics sales recorded USD159.3 billion and USD73.8 billion, respectively in 2023.

- Skin care made up almost a quarter of beauty and personal care’s absolute value gains in 2023. Growth in 2023 was driven by heightened demand in dermocosmetics, premiumisation in body care and product variety shifting towards multifunctionality.

- Health and beauty specialists accounted for 30% of beauty and personal care sales globally, and e-commerce accounts for a fifth of sales in 2023, having grown 9% in 2023 and the year prior.